Image source: Getty Images

Barclays (LSE:BARC) shares are up 80% over two years. It’s a phenomenal turnaround with most of the growth coming in the past 12 months. As such, a £10,000 investment then would be worth around £19,200 today. That’s when we include dividends. Two years ago, the dividend yield was close to 6%.

Explaining the growth

Barclays’ 80% share price surge over two years reflects a confluence of factors. These include its strategic plan and reallocation of risk-weighted assets (RWAs) in February 2024. While the bank’s plan to shift £30bn of RWAs from its investment banking division to higher-returning consumer and corporate banking segments has been a key driver, broader improvements in market sentiment and macroeconomic conditions have also played a significant role. Rising interest rates have bolstered net interest margins, contributing to a 6% rise in total income to £26.8bn in 2024.

Additionally, the FTSE 100 company’s acquisition of Tesco Bank has enhanced Barclays’ retail banking operations, while cost-cutting initiatives have reduced the cost/income ratio to 62%. The bank’s commitment to shareholder returns, including a £1bn share buyback programme and a 5% dividend hike, has further supported investor confidence.

Improving sentiment around the UK banking sector, driven by easing recession fears and stabilising inflation, has also underpinned the rally. However, risks remain, including potential economic challenges and execution challenges in the RWA rebalancing strategy. After all, consumer-focused banks are typically reflective of the health of the economy, and the UK is still misfiring. Barclays’ ability to sustain this momentum will depend on its continued delivery of strategic and financial targets.

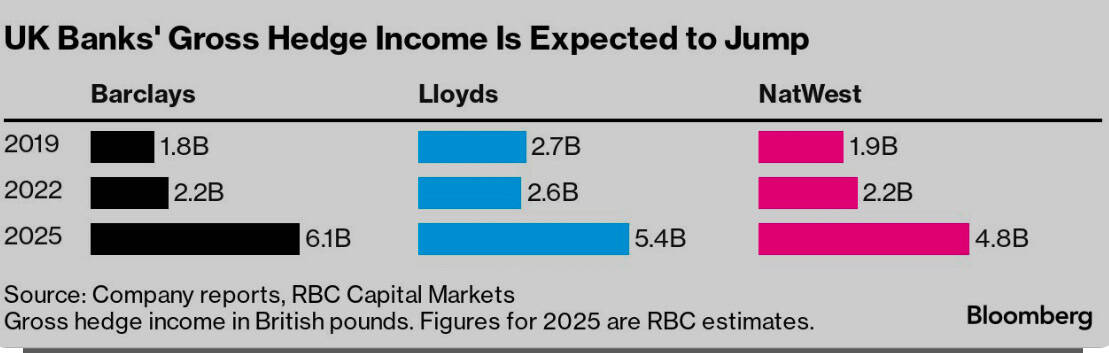

Hedging is central to the current thesis

While the share price is seriously elevated versus two years ago, there’s good reason for it. The UK emerged from a period of very high inflation in potentially the best possible way, and we’re now experiencing a slow unwinding of monetary policy.

Barclays actively manages interest rate fluctuations through a combination of product and structural hedges. The product hedge involves fixed-rate products like mortgages and term deposits, where interest rate risk is mitigated by swapping fixed cash flows to floating rates using interest rate swaps.

The structural hedge, on the other hand, targets rate-insensitive products like current accounts and instant access savings accounts, which are behaviourally stable but exposed to rate fluctuations. Barclays swaps these to floating rates, ensuring income stability and protection against sharp declines in interest rates.

The structural hedge’s average duration is around 2.5 years, balancing income protection with responsiveness to rate changes. During periods of falling rates, such as the 2008-2009 financial crisis, this hedge strategy limited income declines to less than 5%, compared to a potential 90% drop without hedging.

Looking forward, this hedging should deliver significant benefit and often unappreciated income as the Bank of England cuts rates. What’s more, the recent pullback has seen the price-to-earnings ratio fall to a relatively attractive seven times. It’s one of the reasons why I’m considering adding to my Barclays position.