Image source: Getty Images

Looking for the best cheap shares to buy today? Great! Purchasing shares at knock-down prices can lead to significant returns over time.

But I believe investors should seriously consider avoiding these low-cost stocks today. Here’s why.

ASOS

Luxury fashion stocks have long outperformed high street and online retailers. But the trend’s flipped more recently, with eToro data showing a basket of high street stocks rising 11% over the past year. The company’s luxury stock basket has dropped 8% over the timeframe.

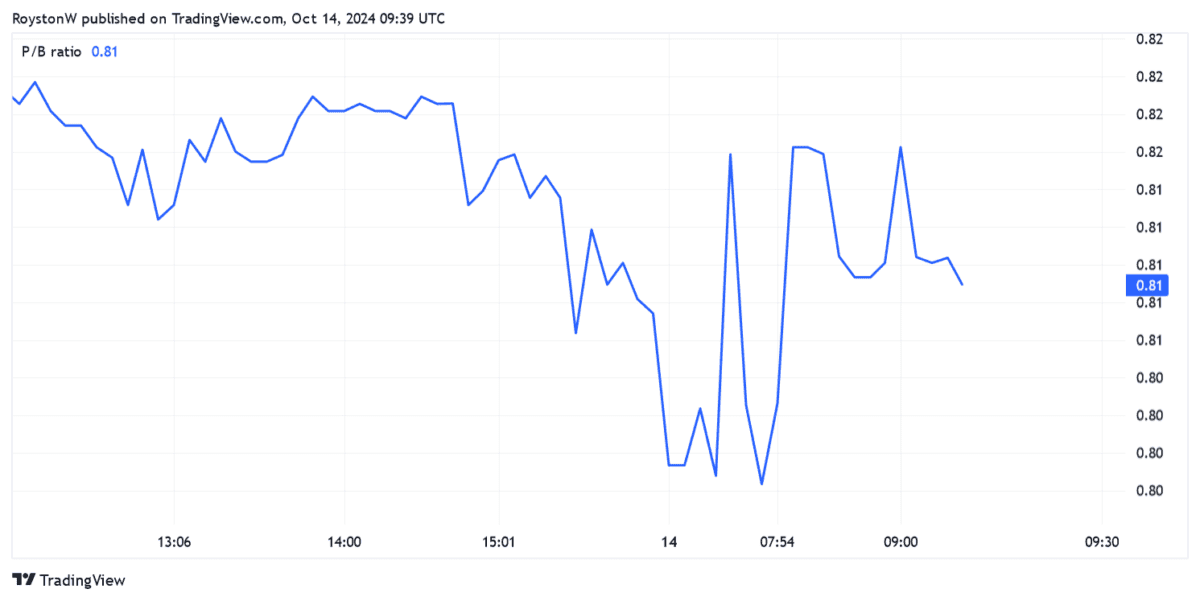

Does this make ASOS (LSE:ASC) a stock to consider today? I don’t think so, even though its shares look dirt cheap right now.

At 421p per share, the retailer trades on a price-to-book (P/B) ratio below 1. This indicates the firm trades at a discount to the value of its assets.

ASOS’s share price has plummeted 87% during the past five years. City analysts expect it to remain loss-making until 2026 at least.

I’m not concerned about its cheapness. It faces huge problems that could continue to dog it for years. Not only is ‘fast fashion’ falling out of favour due to shopper concerns over supply chains and the environment. Rivals such as Shein, Temu and Vinted are growing rapidly, adding extra pressure in what’s already a highly competitive industry.

Recent debt restructuring and the sale of Topshop gives ASOS more financial firepower to boost its turnaround. But though it has more scope to invest in products, for instance, I think the odds still look stacked against the company.

Lloyds Banking Group

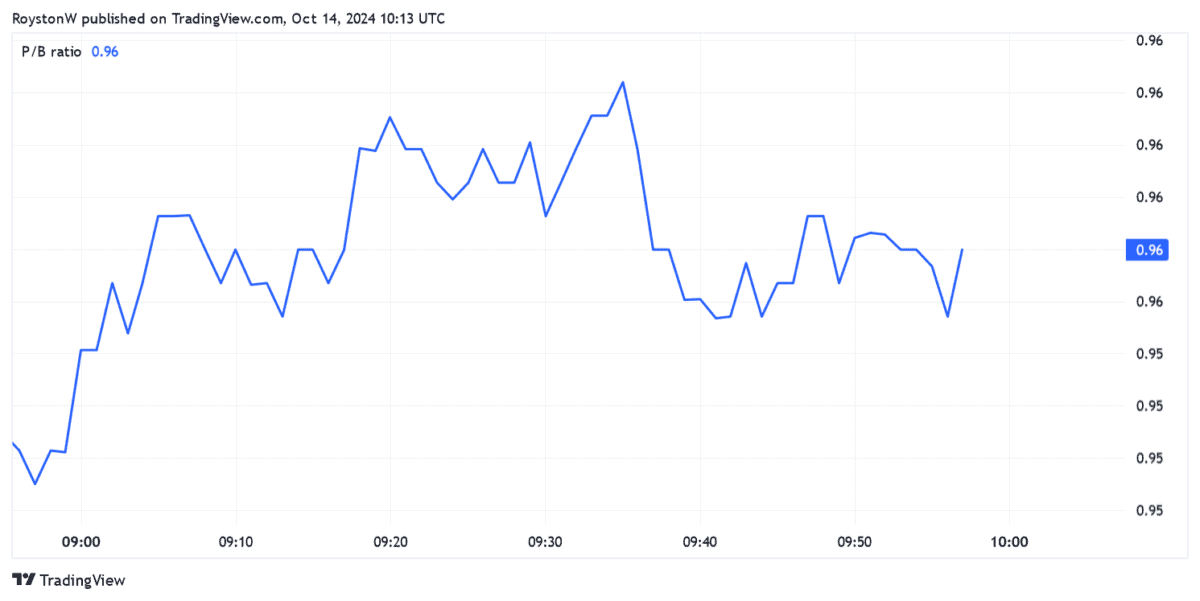

FTSE 100 share Lloyds (LSE:LLOY) might also look appealing for bargain hunters. It trades on a forward price-to-earnings (P/E) ratio of 9.1 times, and carries a large 5.5% dividend yield.

The company also trades on a sub-1 PEG ratio, although the discount in this basis is far narrower here.

City analysts think earnings here will slide 13% this year before rising 12% and 18% in 2025 and 2026 respectively. But Lloyds faces immense challenges to hit these targets, which explains the bank’s low valuation at 59.6p per share.

Like ASOS, the bank faces a struggle to win or even hold on to customers as challengers like Revolut and Monzo flex their muscles. This is far from its only problem either.

Margins could be set for a sustained drop if the Bank of England (as expected) steadily cuts rates as inflation eases. With the UK economy also poised for a long period of low growth, it’s tough to see how retail banks like this will grow earnings.

The ongoing recovery in the housing market’s a good sign for Lloyds. It’s Britain’s biggest home loan provider, so rebounding buyer demand will give earnings a big boost.

But this alone isn’t enough to encourage me to buy the bank. Lloyds’ share price is about 1% lower than it was five years ago. I expect it to continue struggling for growth.