Image source: Getty Images

I’m on the lookout for the best FTSE 250 bargain shares to buy this month, focusing on companies that appear undervalued, according to some — or all — of the following criteria:

Based on the above, here are two of my favourite mid-cap stocks in October.

Babcock International Group

Global defence spending has risen sharply since Russia’s invasion of Ukraine in 2022. As the prospect of Cold War 2.0 grows, fears over Chinese expansion persist, and the Middle East plunges deeper into conflict, arms budgets look set to continue climbing.

I don’t think this is reflected in the cheapness of Babcock International Group‘s (LSE:BAB) share price. Unlike the broader defence sector, it’s failed to sweep higher in 2024. In fact, it’s declined sharply (more on this later).

This means the company trades on a forward P/E ratio of just 10.9 times. This is much lower than the corresponding readings of other major US and UK defence companies, as the table below shows.

| Stock | Forward P/E ratio |

|---|---|

| BAE Systems | 19.1 times |

| Chemring Group | 18.1 times |

| Rolls-Royce | 29.3 times |

| RTX | 22.6 times |

| Northrop Grumman | 21.2 times |

| Lockheed Martin | 23 times |

As well as carrying a rock-bottom P/E ratio, Babcock also deals on a PEG ratio of just 0.3. A reading below 1 implies a stock’s undervalued.

So why is the company so cheap? One reason is that it’s more dependent on UK orders than the broader industry. This means its long-term outlook’s less assured as Britain’s high public debts impact spending on things like defence.

Babcock’s low valuation also reflects expectations of weakening cash flows this year. But while they’re significant, I believe these issues are currently more than factored into the cheapness of the company’s shares.

Babcock’s orders rose £800m last year to top £10.3bn. I believe it’s in great shape to continue chalking up new contracts.

Mitchells & Butlers

Purchasing retail and leisure stocks is riskier today than usual as Britain’s economy splutters. For Mitchells & Butlers (LSE:MAB), the number of pints it pulls and meals served may fall as people eat and drink at home instead of at the pub.

Still, like Babcock, I think these threats are baked into the pub chain’s ultra-low share price. It trades on a P/E ratio of 11.1 times.

What’s more, the company’s PEG ratio sits way back at 0.2.

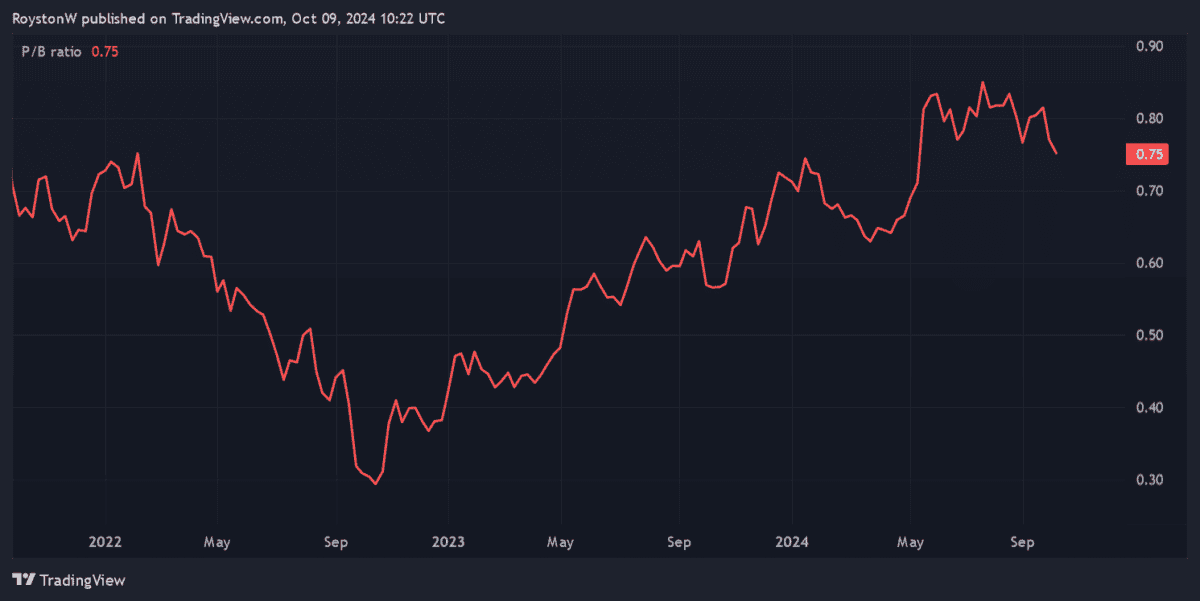

If all this wasn’t enough, Mitchells & Butlers’ shares also trade well below the value of the firm’s assets. Its P/B ratio sits comfortably below the bargain benchmark of 1, as the chart below indicates.

Though consumer spending’s weak, I’m encouraged by the rate at which sales here are rising. Like-for-like revenues increased 5.2% in the last financial year, which is thanks in part to strength of its brands such as Harvester, Toby Carvery and All Bar One.

Mitchells & Butlers is also benefitting from falling competition in the domestic pub industry. With the business also demonstrating a firm grip on costs, I think this FTSE 250 value share’s worth a close look.