Image source: Getty Images

Penny stocks are inherently risky due to their small market caps and volatile prices. Without the solid foundation of decades of business and reliable funding, a small problem can derail a small company.

As a highly risk-averse investor, I tend to avoid penny stocks for that reason, but I also recognise the opportunity. After all, even today’s mega-cap stocks were penny stocks at some point.

So for investors looking to get in early and aim for life-changing wealth, the attraction is clear.

With that in mind, I’ve identified two micro-cap stocks that I think could benefit from the recent uptick in gold interest following US inflation data.

Serabi Gold

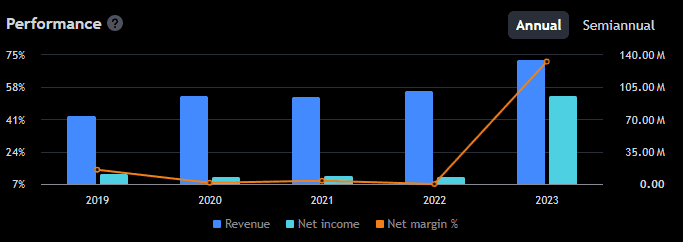

Headquartered in Cobham, Serabi Gold (LSE:SRB) explores and excavates for gold and copper in northern Brazil.

Even more than gold, Serabi has been on a tear this year, up over 120%. In fact, a recent price surge took it just outside of penny stock territory to 108p. But with an £80m market cap, it’s still very much a micro-cap stock.

Even more impressive than the price surge is earnings, up 339% in the past year. Clearly, it struck gold! This also means it has a low price-to-earnings (P/E) ratio of around five, well below the industry average of 9.9.

That suggests there could be more room for growth.

With an expectation of strong future cash flows, it’s now estimated to be undervalued by 87%. What’s more, earnings are forecast to continue growing at a rate of 37.8% per year.

My core concern is that it’s coming close to a five-year price high. That could lead to significant selling pressure if investors look to take profit. Plus, it’s closely tied to the gold price so any drop there is likely to hurt the share price.

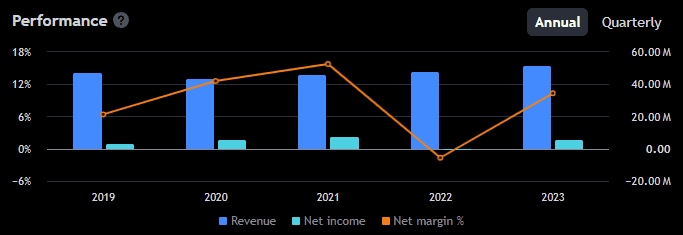

Metals Exploration (LSE: MTL) is another micro-cap mining outfit that benefited from this year’s gold price growth. It’s up 76% year to date and 344% over five years.

The business is headquartered in London but operates in the Philippines. It excavates for gold and precious metals from mines north of the capital, Manila. Despite a higher £88m market cap, the shares, at only 5p, are much cheaper than Serabi.

And not due to poor performance — earnings increased 213% in the past year with revenue close behind. Cash has also been growing steadily since the company became profitable in 2020.

Consequently, it’s estimated to be trading at 90% below fair value using a discounted cash flow model. It also has a squeaky clean balance sheet, with no debt and $191m in equity.

There is a big ‘but’ though, and unlike Sir Mixalot, I don’t like big buts.

Earnings are forecast to decline by an average of 60.3% per year for the next three years. That’s not entirely surprising — considering the recent growth — but it won’t look good in the interim results. It could spook shareholders and lead to a fall in price. And the price is already very volatile, rising 117% earlier this year only to crash 35% straight after.

So it’s not for faint-hearted investors like me!

As mentioned above, I don’t have the risk appetite for volatile penny stocks so I won’t be buying either stock. But for brave investors looking to gain exposure to gold, these two exhibit better growth potential than similar competitors I’ve researched and are worth a look.