Image source: Getty Images

Scottish Mortgage Investment Trust (LSE: SMT) aims to invest in the world’s best growth shares. These come in different forms, from established businesses to newer enterprises making waves somewhere in the world.

A few days ago, the trust revealed its newest portfolio holdings — and they’re certainly very different companies. One originated in Paris in 1837, while the other was founded in 2013 in Brazil.

Here’s the lowdown on these latest moves.

Iconic luxury goods

The first new addition is Hermès International, the French luxury brand known for its silk scarves and leather goods like the Birkin bag.

Scottish Mortgage said that 187-year-old Hermès “still has exceptional growth potential… underpinned by a strategic marriage of its storied brand with the dynamic expansion of emerging Asian economies”.

Like Ferrari (another holding), Hermès’ customers must be invited to buy its higher-end products, which helps maintain its aura of exclusivity. Both are regularly ranked as the world’s most valuable luxury brands.

Of course, the company faces competition from the likes of Louis Vuitton, while future shifts in consumer preferences are always a possibility. However, this looks like a solid portfolio addition to me.

The other Nu stock

The second share is Nu Holdings (NYSE: NU). This is a digital bank (better known as Nubank) in Latin America that’s growing rapidly. This is reflected in its share price, which is up 215% in two years.

Scottish Mortgage said Brazil’s Nubank “has attracted and retained younger customers who are expected to increase their income significantly over the next decade“.

Incredibly, the firm now has over 104m customers, despite operating in just three countries (Brazil, Mexico, and Colombia). Further international growth seems certain.

As of the second quarter, it had added more customers in the previous 12 months than the five largest Brazilian incumbents combined. Over half of Brazilian adults are now Nu customers!

In 2023, revenue surged 67% year on year to reach $8bn. Analysts expect the top line to increase another 45% this year, then climb to around $20bn by 2026. So this is a hyper-growth fintech company.

Also very profitable

But it’s not just revenue growing. Nubank’s net income more than doubled in the second quarter, reaching $487m. The net profit margin here’s not far off 20%. That’s very attractive for an innovative company still growing revenue at 40-60% a year.

The firm also boasts one of the highest return on equity (ROE) in the industry at 28%. This indicates that it’s using shareholders’ equity very efficiently to generate profits.

Interestingly, the stock’s held by Warren Buffett’s Berkshire Hathaway too. And though Latin America offers heightened risks of currency and economic volatility, which could impact Nubank’s earnings, Buffett’s yet to sell a single share since investing in 2021.

Set up to win?

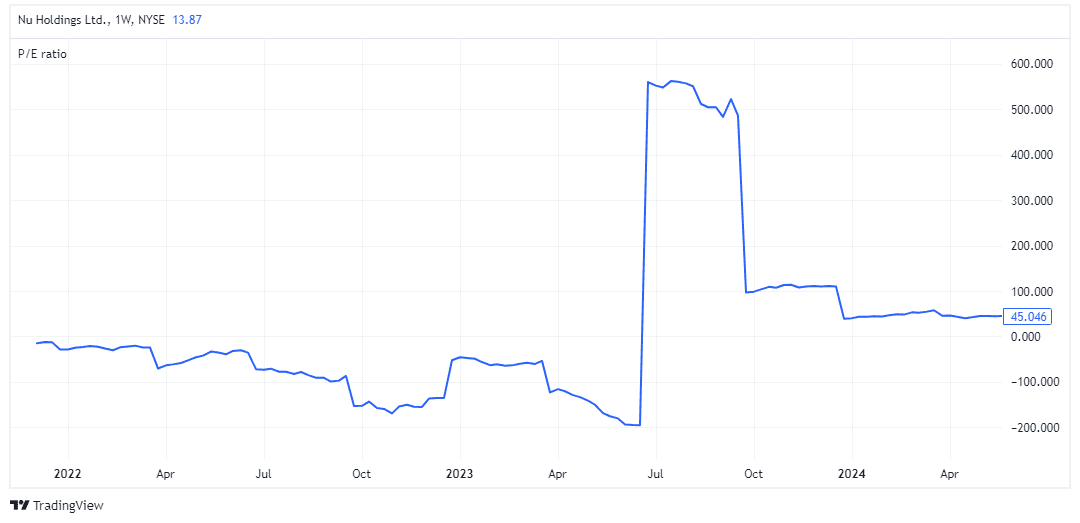

At first glance, the stock isn’t cheap at 45 times earnings.

However, the company’s growing earnings so quickly that it’ll probably look like a bargain in future. Based on forecasts for 2026, for example, the forward P/E ratio is just 16.

As a shareholder in Scottish Mortgage, I think these look like two exciting purchases. And while a sharp market sell-off in growth stocks is an ever-present risk, the portfolio looks set up to win long term.