Image source: Getty Images

In late 2022, ChatGPT was released into the world and ignited the generative artificial intelligence (AI) boom. This immediately benefitted many growth stocks on the hardware side, especially chipmaker Nvidia, whose shares are up 659% since January 2023.

The second foundational layer of the AI revolution is made up of platforms that enable the technology. Think cloud giants such as Amazon Web Services (AWS) or Microsoft Azure.

Now though, we’re increasingly seeing companies integrate cutting-edge AI into their products. This application phase is where transformative impacts are likely to emerge. Here are two growth stocks that are rolling out impactful AI-powered products. Both are worth a look, in my opinion.

Axon

The first is Axon Enterprise (NASDAQ: AXON). This company is best known for its Taser stun guns and body cameras used by law enforcement agencies.

However, the secret sauce is that these devices are connected through a public safety operating system. Indeed, Axon now has over 1m software users.

In Q4, the firm’s revenue grew 34% year on year to $575m, representing its 12th consecutive quarter of 25%+ growth. Q4 was also when it released its AI Era Plan, which bundles existing and future AI products into a single subscription service.

One is Draft One, a generative AI tool that transcribes audio from Axon’s body cameras and produces draft reports within minutes of an incident. While police officers are required to review the AI-generated reports before submission, this still holds the promise of game-changing productivity gains.

In February, CEO Rick Smith said: “These [AI products] are the fastest-growing adoption products we’ve ever had, and it’s not by a small margin.”

One risk here is wide-ranging US budget cuts, which could hurt Axon’s ability to win further federal contracts.

However, the stock’s fallen 20% inside two months. While that doesn’t make it cheap — it’s still trading at a lofty 88 times forward earnings — I reckon the pullback’s worth considering.

Duolingo

The second stock is Duolingo (NASDAQ: DUOL), the online language learning leader that now has over 116m and 40m monthly and daily active users respectively.

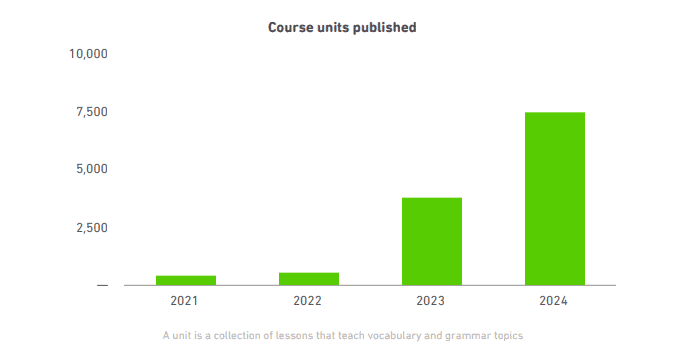

Generative AI is benefitting Duolingo in a number of ways. For starters, it is using the technology to massively accelerate content generation at minimal extra cost. In 2024, it deployed 7,500 course units, up from just 425 in 2021.

Second, it has launched an AI-powered video call feature that enables learners to have real-time, spontaneous conversations with a virtual character. This addresses two common challenges in language learning: the lack of opportunities to practise with native speakers and removing the embarrassment when making errors with human tutors.

The video call feature is available exclusively to Duolingo Max subscribers (its highest-priced tier). Yet it already accounted for 5% of paid subscribers in Q4. And it’s proving a hit with English language learners, who often need real-world English speaking skills for work or study.

As for risks, a potential global recession could cause some users to downgrade from premium subscriptions. So this is worth monitoring.

Longer term though, there is an enormous opportunity with English learners. They represent roughly 80% of the 2bn or so language learners worldwide, but only 46% of Duolingo’s 40m daily active users.

After a 25% fall since mid-February, I think the stock is worth further research.