Image source: Getty Images

Dividends from UK shares are never, ever guaranteed. As we saw during the Covid-19 crisis, even the most generous and financially secure company can postpone, suspend, or axe shareholder payouts when catastrophes happen.

But as investors, we can take steps to minimise the chances of dividend disappointment. Choosing defensive companies that enjoy stable earnings (like utilities, healthcare providers, and food manufacturers) is one tactic.

So is selecting companies with strong balance sheets, market-leading positions, and diversified revenue streams. This can protect earnings when economic conditions suddenly worsen.

It’s also important to spread one’s capital across a variety of different shares. Such diversification reduces the impact of company and industry-specific factors on investors’ returns.

Three top stocks

With all this in mind, here are three super-safe dividend shares on my watchlist today.

| Dividend share | Forward dividend yield |

|---|---|

| Assura (LSE:AGR) | 8.2% |

| Legal & General | 9.5% |

| Diageo | 3.1% |

As I say, dividends are never a sure thing, and broker projections can sometimes fall short. But if current forecast are correct, a £20,000 investment spread equally across these dividend shares would provide a passive income of £1,380 this year alone.

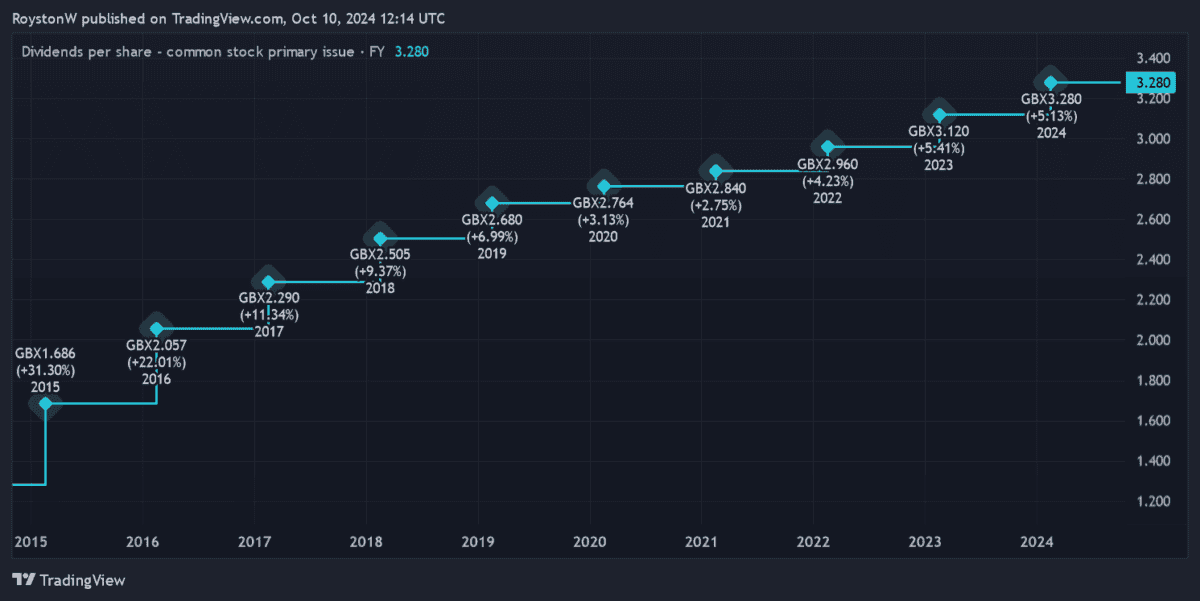

A top REIT

Out of this bunch, let’s take a deep dive into Assura first. As the chart above shows, this FTSE 250 company has a long history of dividend growth even during times of crisis.

City analysts expect this proud record to continue, too, even as the threat from high interest rates remains.

As a result, the firm’s dividend yields lift to 8.5% for next year, and to 8.6% the year after.

Elevated interest rates depress net asset values (NAVs) for property stocks and can significantly raise their borrowing costs. But the defensive nature of Assura’s operations — it owns and lets out primary healthcare properties, like doctor surgeries — allows it to pay a large and growing dividend each year.

The real estate investment trust (REIT) is expanding rapidly, to help it grow earnings beyond the medium term. But sector rules mean that this expensive programme doesn’t have catastrophic implications for dividends.

Under REIT regulations, Assura must pay a minimum 90% of annual rental profits out in the form of dividends. Combined, these factors make the business a rock-solid income pick in my book.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

FTSE 100 dividend stars

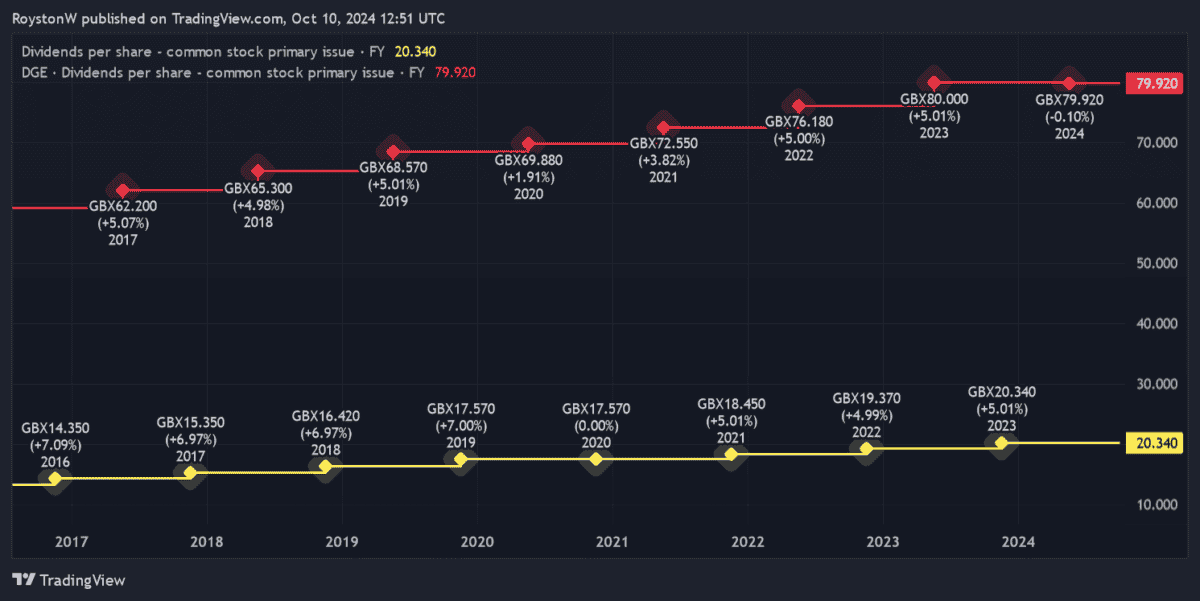

Combined with Legal & General and Diageo in a portfolio, I think I could enjoy a truly spectacular dividend for years to come. As you can see, these two stocks also have long histories of sustained payout growth.

Financial services firm Legal & General doesn’t operate in a defensive sector. Indeed, future sales may remain vulnerable if interest rates remain high.

But the FTSE 100 firm’s balance sheet has still allowed it to regularly grow dividends over the past decade. And with a Solvency II capital ratio of 223%, it remains cash rich today.

Diageo, meanwhile, is another reliable dividend stock thanks to its strong position in the largely resilient alcoholic drinks market. While it faces extreme competitive pressures, fashionable labels like Guinness and Captain Morgan help to lessen this threat.

I also like the Footsie firm’s wide diversification across different geographies and drinks segments. This provides earnings (and thus dividends) with added stability.