Image source: Getty Images

There are plenty of ways that investors can target a second income in retirement.

Some methods may be more successful than others. There’s also no blueprint for investors to follow, as the strategies someone adopts will depend on their individual circumstances, financial goals and risk tolerance.

That said, certain ‘golden rules’ exist when it comes to saving or investing. Regardless of personal situation, they can be powerful weapons in creating long-term wealth.

1. Bypass the taxman

The first thing to consider is using a Self-Invested Personal Pension (SIPP) or Individual Savings Account (ISA) to invest. Within the ISA category, a Stocks and Shares ISA and/or Lifetime ISA can be used to buy shares, trusts and funds listed in the UK and overseas.

With both an ISA and a SIPP, an investor doesn’t pay a single penny in tax on any capital gains and dividends. And given the large annual allowances on these products — £20k on a Stocks and Shares ISA, and a sum equivalent to one’s yearly earnings (up to £60k) — the savings can be considerable.

As dividends and share prices (hopefully) grow, the amount saved on taxes could grow considerably too. Over two-to-three decades we could be talking many tens — or even hundreds — of thousands of pounds.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

2. Diversify

With an ISA and/or SIPP set up, the next thing to consider is creating a diversified portfolio of shares and other assets. This reduces risk, provides exposure to different investing opportunities, and typically delivers a smoother return over the economic cycle.

A trust like the The City of London Investment Trust (LSE:CTY) could be an effective stock to consider targeting this. Dating back to 1932, this is one of the oldest London-listed trusts, and has around £2.4bn worth of assets.

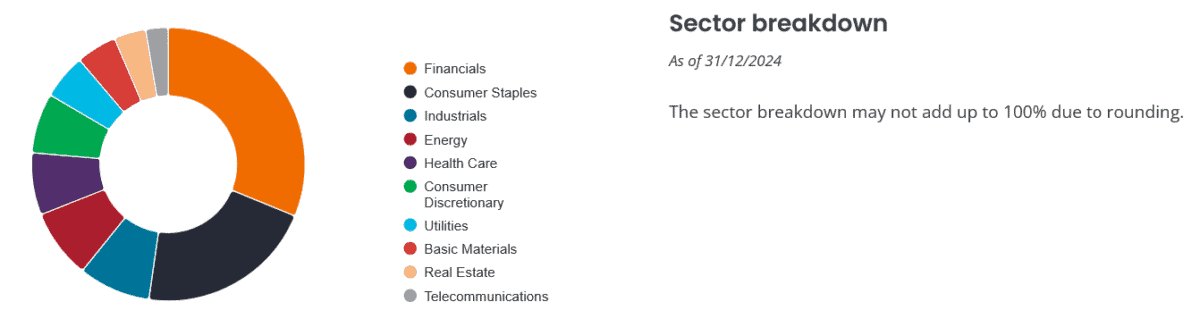

It’s focused on delivering a blend of growth and passive income through exposure to 10 different sectors. Some of its largest holdings include HSBC, Shell, RELX, Unilever and British American Tobacco.

Almost 90% of the fund is tied up in UK equities, which could leave it vulnerable if market appetite for British assets trends lower. But I’m confident it could continue to be an effective diversification tool over the long term.

Since 2005, the trust has delivered an average annual return of 6.4%. If this continues, a £500 monthly investment over 30 years creates a retirement fund of £553,089.

3. Buy dividend shares

Once they hit retirement, an investor has a number of options open to them to add a second income to their State Pension.

They can buy an annuity, or draw down a percentage from their portfolio. Alternatively, they might invest their money elsewhere (like in buy-to-let property for a regular rental income).

Another option is to target a passive income from high-yield dividend shares. This can deliver a steady stream of cash through regular dividend payments as well as provide scope for capital appreciation.

Additionally, this method offers the possibility of dividend growth over time, which can help mitigate the eroding impact of inflation on an individual’s passive income.