Image source: Getty Images

A stock market crash might seem like an intimidating prospect. But for those who are prepared, it can be an opportunity to make life-changing investments.

Historically, the best returns come from buying shares when prices are low. So while it’s impossible to know when the next crash is coming, investors should probably be on the lookout.

Equity returns

There’s no magic formula that can tell you exactly when is the best time to buy shares. But that doesn’t mean investors shouldn’t try to make the most of the information that is available to them.

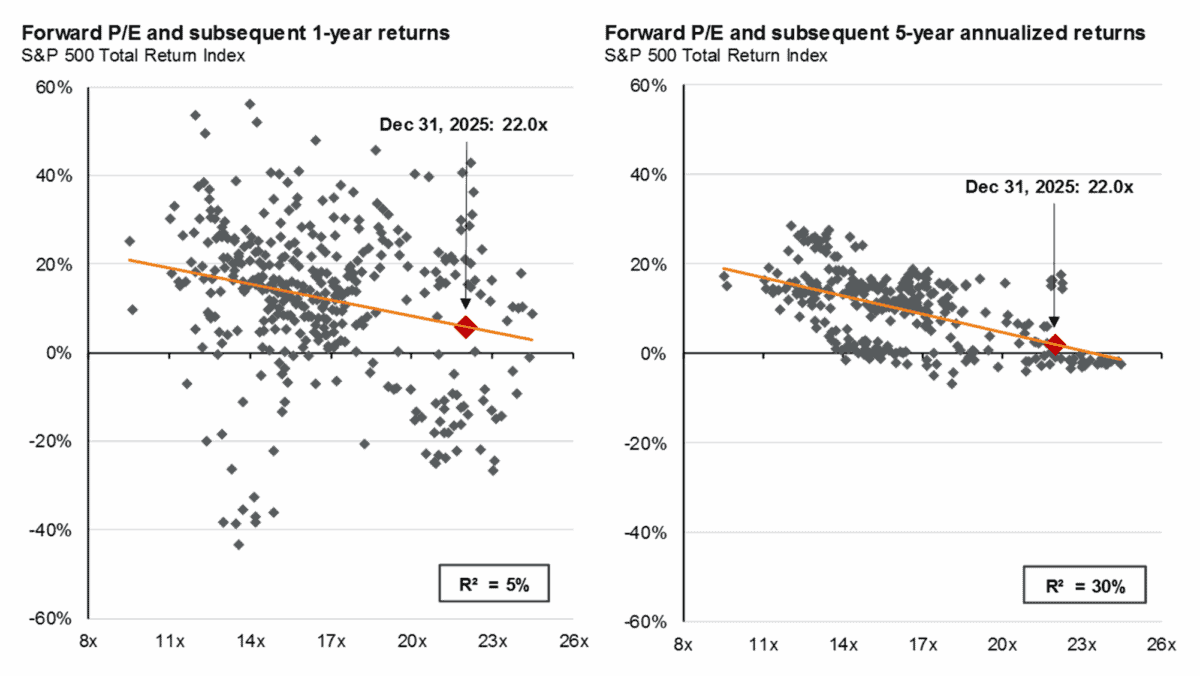

Data from JP Morgan Chase shows a strong negative correlation between valuations and returns. Put simply, returns have been best when the S&P 500 has traded at lower price-to-earnings (P/E) ratios.

Source: JP Morgan Guide to the Markets Q1 2026

The correlation isn’t perfect – especially over a short timeframe. But it becomes much stronger over a five-year period and this is something investors should pay attention to.

At the start of the year, the S&P 500 was trading at a level corresponding to an average five-year return of around 3%. But if the multiple falls 20%, that historic figure doubles.

What to do?

This might make it look as though the best thing to do is to wait until a better buying opportunity presents itself. But I don’t think that’s a particularly good idea.

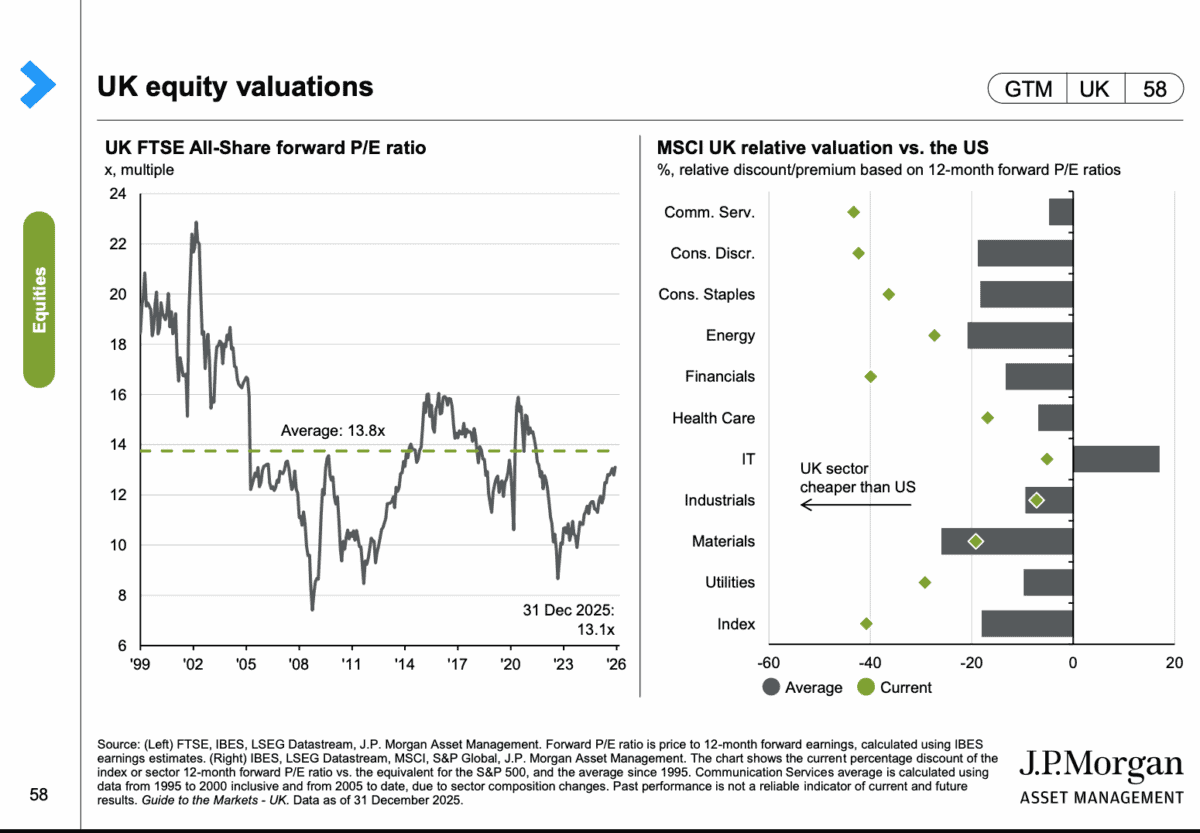

The S&P 500 as a whole might be historically expensive, but this isn’t true of stocks around the world. UK shares, for example, are actually trading at unusually low levels at the moment.

Source: JP Morgan Guide to the Markets – UK Q1 2026

It’s also worth noting that it isn’t even true of every stock within the S&P 500. A lot are actually trading at historically low multiples right now.

The best opportunities might come from taking advantage of low prices. But investors don’t have to sit around and wait for a stock market crash.

Looking for opportunities

One example from my portfolio is Gamma Communications (LSE:GAMA). At a price-to-earnings (P/E) ratio of 13, the stock is trading at a level well below where it’s been in the past.

The reason I own it, though, isn’t just because it’s historically cheap. I think the company is in a really nice position to benefit from the UK’s upcoming shift away from copper phone lines.

There’s a danger the UK might delay switching off its copper network (it’s happened once before) and this wouldn’t be a good thing for Gamma. And that’s the main risk with the stock right now.

Sooner or later, though, businesses are going to have to move to cloud communications – which is the firm’s speciality. So even if it doesn’t come this year, I think the long-term picture looks good.

Financial freedom

Achieving financial freedom involves two things. The first is being able to put money aside and the second is finding ways to earn a good return on that capital.

When it comes to the second, the record of history is very clear. The best returns from the stock market come from buying when valuation levels are unusually low.

Given this, a stock market crash can present life-changing opportunities. But I don’t think investors have to wait for something dramatic to happen to find stocks to buy.