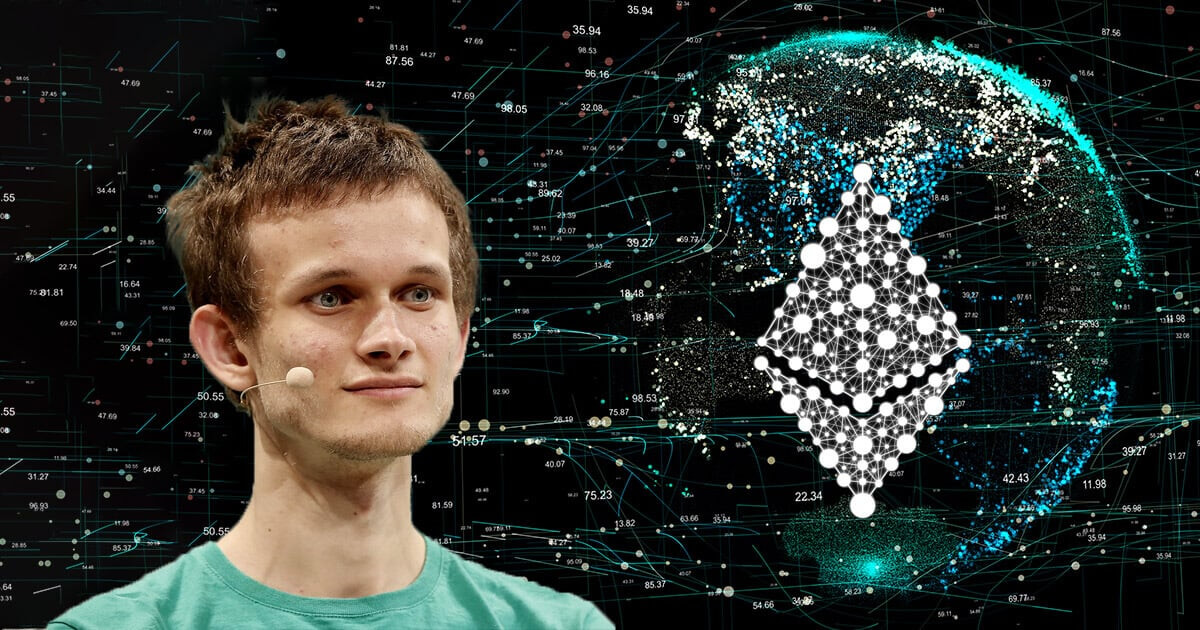

According to Vitalik Buterin, the Bitcoin block size war of the 2010s remains a significant event in the cryptocurrency’s history. The conflict, which centered around whether to increase Bitcoin’s block size, saw two distinct factions: the small blockers, who favored a conservative approach, and the big blockers, who advocated for larger blocks to accommodate more transactions.

Small Blockers’ Perspective

Jonathan Bier’s book, “The Blocksize War,” presents the small blockers’ viewpoint. The debate initially revolved around whether Bitcoin should undergo a hard fork to raise the block size limit, which would allow more transactions but make the chain more difficult to run a node for and verify.

Bier portrays small blockers as prioritizing the ease of running a node. They believed that changes to Bitcoin’s protocol should be rare and achieved with a high level of consensus. According to them, Bitcoin’s unique value lies in its decentralization and resistance to control by central organizations. They were wary of governance structures that could lead to centralized decision-making, fearing it would undermine Bitcoin’s core principles.

Small blockers were particularly opposed to attempts by big blockers to push changes through by garnering support from a small number of influential players, which they saw as an affront to the decentralized ethos of Bitcoin.

Big Blockers’ Perspective

On the other side, Roger Ver and Steve Patterson’s “Hijacking Bitcoin” advocates for the big blockers. Big blockers argue that Bitcoin was originally envisioned as digital cash, not just a store of value. They cite Satoshi Nakamoto’s writings, which support increasing the block size to facilitate more transactions and lower fees.

Big blockers contend that the pivot towards treating Bitcoin as digital gold was orchestrated by a small group of core developers. They argue that this shift ignored the broader community’s needs and imposed an elitist governance model. While small blockers proposed layer-2 solutions like the Lightning Network to maintain Bitcoin’s usability as digital cash, big blockers criticized these solutions as inadequate and overly complex.

Key Differences and Consensus

Both sides agree on the importance of decentralization but differ in their approach. Small blockers focus on maintaining low-cost node operation and strict protocol conservatism, while big blockers emphasize transaction affordability and usability as digital cash.

Bier’s narrative acknowledges the sincerity of many big blockers’ grievances, particularly regarding censorship by small block advocates. However, Bier criticizes the big block camp for incompetence, citing poorly implemented software and security vulnerabilities. Conversely, Ver’s book ascribes more malicious intent to small blockers, accusing them of benefiting financially from the limitations they imposed on Bitcoin.

Lessons and Future Outlook

Buterin’s reflections reveal his initial alignment with the big blockers, driven by concerns over high fees and the untested nature of layer-2 solutions. He criticizes both sides for their extremes, advocating for a balanced approach to managing Bitcoin’s scalability and decentralization.

He underscores the importance of technological innovation over political compromise in resolving such conflicts. Buterin highlights the potential of ZK-SNARKs and other advanced cryptographic techniques to enhance scalability and privacy, which were overlooked during the block size war.

Ultimately, Buterin’s analysis serves as a reminder that the lessons from Bitcoin’s block size war extend beyond cryptocurrency. They offer valuable insights into governance, decentralization, and the challenges of maintaining a democratic ethos in any digital community.

Image source: Shutterstock

. . .

Tags