Image source: Getty Images

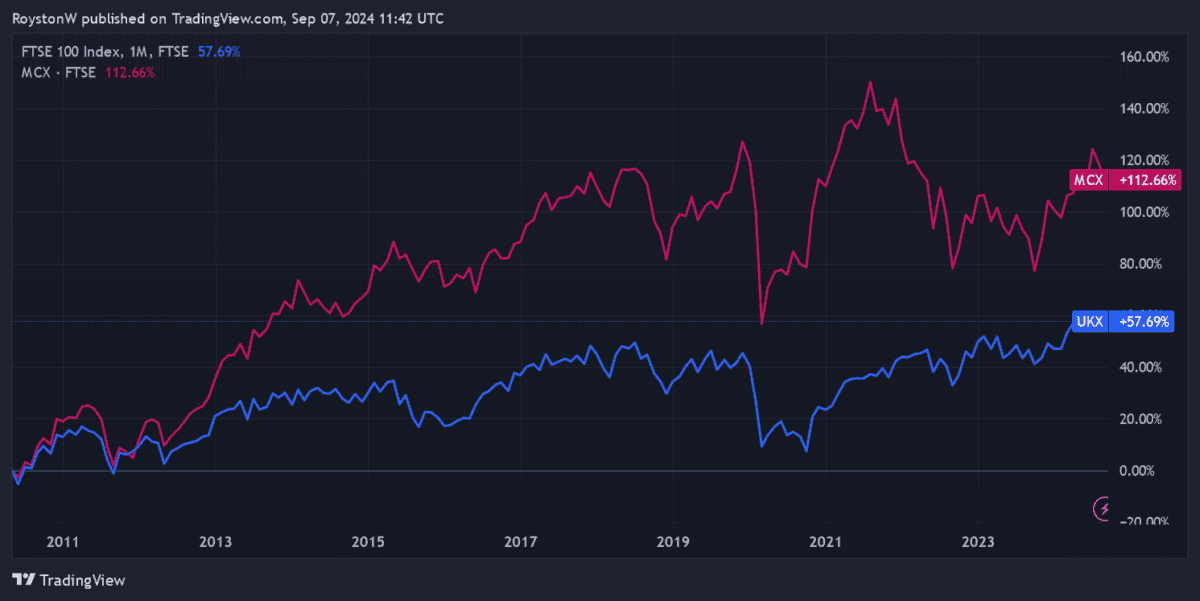

Thanks to an average annual return of 11% since 1992, investing in FTSE 250 stocks has proved a lucrative strategy for many investors.

If this trend continues, a £300 monthly investment today in a FTSE 250-tracking fund would, after 30 years and with dividends reinvested, make me a whopping £841,356.

This is much better than I could expect to make by buying just FTSE 100 shares. Remember though, that past performance is no guarantee of future returns.

But why is the UK’s mid-cap index so lucrative? One reason is that companies of this size are often in the growth phase of their business cycles which, in turn, can lead to stunning share price growth.

Another is that they can be more agile and thus able to capitalise on market opportunities. The result is they can often achieve faster profits growth than large-caps like we see on the Footsie.

Pros and cons

So how can investors harness this massive potential? They can invest in an ETF as I described above. This provides excellent diversification across all 250 shares. Some of these funds are extremely low cost too, with management charges of just 0.1%.

However, there are also drawbacks to this approach.

I can’t customise my portfolio and only choose stocks that, for instance, align with my broader investment strategy or ethical values. Dividends from the underlying stocks are also typically pooled and paid out on a set schedule, meaning I don’t have control over when I receive my passive income.

Finally, a tracker fund only delivers average returns across all companies. Some stocks in the index might be underperformers which, in turn, can significantly impact the profits I make.

One top stock

By carefully selecting high-performing stocks instead, I have the potential to achieve excellent returns that outperform the wider index.

Again, owning a small pool of stocks carries greater risk than investing across the whole FTSE 250 with an ETF. But if I have a knack of choosing stock market winners, this might be the best way for me to go.

Greggs (LSE:GRG) is one such share I’d invest in today with cash to spare. Its share price has soared almost 500% over the past decade and has considerable more growth potential, in my opinion.

This success isn’t because its products are revolutionary. The teas, sausage rolls and doughnuts that the baker produces have been staples of the ‘Great British Menu’ for generations.

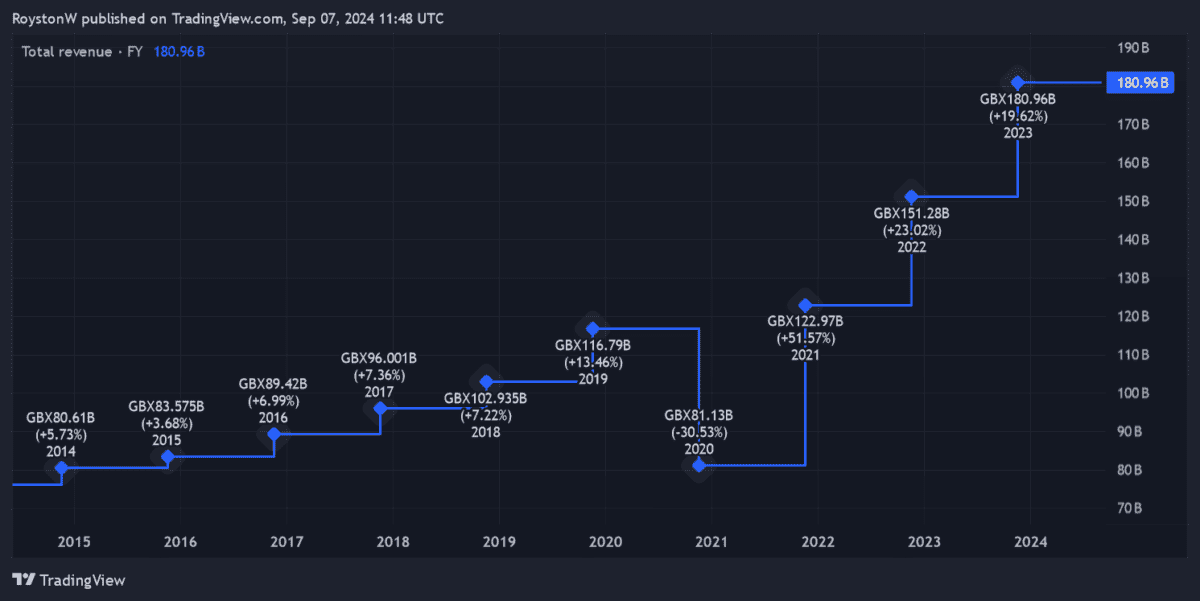

Instead, Greggs is engaged in rapid expansion to capitalise on the enduring popularity of its edible goods. It has 2,524 shops as of June, up from 1,661 a decade earlier.

Excluding the pandemic, this has driven healthy revenues growth over the period.

Rapid expansion like this always carries risk. For instance, Greggs could experience problems ramping up manufacturing capacity to stock its new shops.

But so far, the baker’s managed its ambitious growth strategy extremely well. And with it targeting 3,500 stores, I think the future looks bright.