Nvidia (NASDAQ:NVDA) shares have endured a fresh battering as worries over the US economy have resurfaced. At $107.20 per share, they’ve dropped roughly 8% over the past seven days.

Could this represent an attractive dip buying opportunity? I’m not so sure, to be honest.

The chipmaker clearly has lots of growth potential as the artificial intelligence (AI) boom supercharges sales. But there are also risks here, including potential supply problems, rising competition, and further US-imposed curbs on exports to China.

And given Nvidia’s still-meaty valuation, I’m not prepared to buy its shares for my portfolio. Here are two other investments I’d rather buy to harness AI growth if I had cash to invest.

Sage Group

Sage Group (LSE:SGE) is famous for making accounting, payroll, and human resources software for companies. And it’s been building a pipeline of AI-related tools in recent years, resulting in the rollout of generative AI tools Sage Network Inbox and Sage Copilot earlier this year. There’s more to come too.

Interestingly, Sage is also seeking collaborations to develop domain-specific AI models to enhance its existing cloud-based offerings. It launched one such endeavour with Amazon Web Services (AWS) back in February.

The business has predicted that AI will “change the nature” of accounting, and is establishing foundations to be at the forefront.

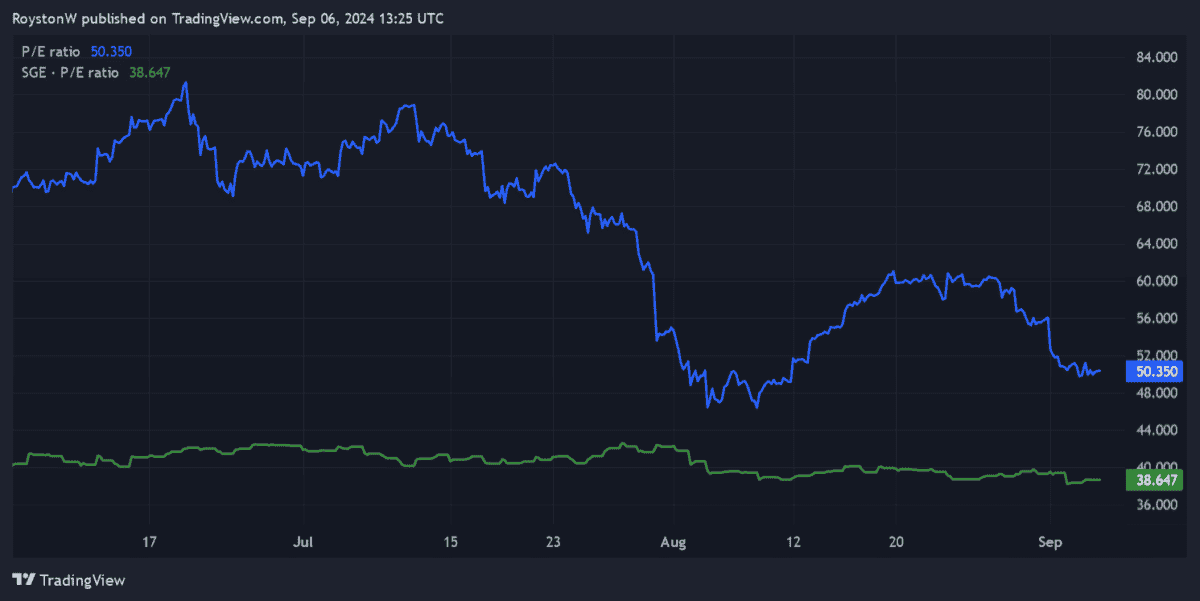

Sage’s shares certainly offer better value than Nvidia. As the chart above shows, the FTSE 100 company trades on a trailing price-to-earnings (P/E) ratio of around 38.7 times. This is well below a corresponding reading of 50.4 times for the chipmaker.

Look, this is still a high reading on paper, which in turn leaves the company more vulnerable to a share price correction than most other shares.

But Sage’s valuation isn’t in nosebleed territory. In fact, it’s not far above the five-year average of 33 times. At these prices, I think the company’s worth a closer look.

A top ETF

A leftfield to capitalise on AI is to invest in industrial metals like tin. The WisdomTree Tin (LSE:TINM) exchange-traded fund (ETF) is one I’ve been looking at to build long-term wealth. It’s up 19% over the past year and 132% in the past five.

The fund tracks the Bloomberg Commodity Tin Subindex 4W Total Return Index, which itself follows the performance of tin futures contracts. I believe it has explosive investment potential given tin’s vital role in the manufacture of circuit boards and semiconductor chips.

The International Tin Association predicts that semiconductor demand will grow 7% each year through to 2030.

Okay, there are problems with commodity ETFs like this. Issues like tracking errors and low market liquidity mean the fund doesn’t always track the tin price exactly, as the chart above shows. Tin prices can also slip during economic downturns.

But the potential long-term rewards still make it very attractive, in my book. With tin demand for green technologies (like solar panels and electric vehicles) also soaring, analysts are expecting a big supply deficit to emerge by 2030 that could send the metal’s prices through the roof.