Whenever I have spare cash, I invest in companies inside my Stocks and Shares ISA. Eventually, I’d like to live off the passive income generated from this portfolio.

However, this isn’t a get-rich-quick strategy. I’m going to have to be patient.

But the good news is that small amounts can add up to a surprisingly large amount, given enough time.

Passive investing

One of the simplest ways to build up a portfolio is through low-cost exchange-traded funds (ETFs). These allow people to invest in multiple stocks, bonds, property, and more, in one fell swoop.

Many UK investors gravitate toward the FTSE 100, known for its stability and generous dividends. The long-term annual average is around 8%.

However, it’s a fact that many of the world-changing firms are listed across the pond. Their products dominate our day-to-day lives, whether that’s iPhones (Apple), entertainment (Disney and Netflix), Facebook and Instagram (Meta Platforms), or Google search (Alphabet).

The S&P 500, with its significant exposure to technology stocks, has generated average returns of around 10% (including dividends).

Passive income potential

Let’s assume I invest passively in both indexes and the historical returns stay broadly the same (which isn’t guaranteed). So that’s 9%.

In this scenario, I’d end up with £1,159,308 after 35 years of investing just £99 a week (not including any platforms fees). And that’s starting from scratch!

At this point, I could employ the 4% withdrawal rule. This would see me drawing down £46,372 a year.

Active investing

Rather than passive investing, though, I’ve decided to take an active, stock-picking approach. This is riskier and more time-consuming, but the potential rewards are far greater.

Axon Enterprise (NASDAQ: AXON) is a great example of this. The stock is up almost 1,300% since my initial investment in 2017. It’s been an incredible long-term winner and is now at a record high.

The firm has evolved from selling just Tasers into a mission-critical public safety technology platform. Today, its products range from body and vehicle cameras to cloud-based AI services and drones.

Many police officers in the US and UK now wear Axon’s body-cams (for accountability and evidence gathering) and Tasers (for safety and a less-lethal option than guns). This is contracted recurring revenue for Axon.

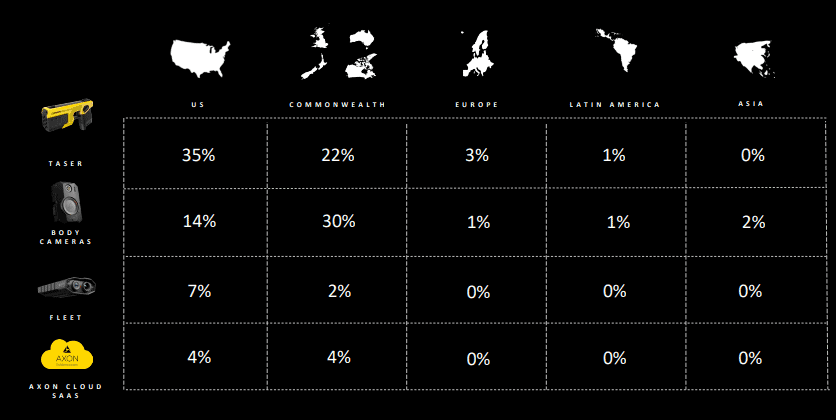

However, the wider international opportunity for both products remains absolutely massive. The market penetration rate in Europe, Asia, and Latin America is basically near 0%!

In Scotland, the police, lawyers, and the courts all now rely on Axon’s unified evidence database. The mind boggles at the growth potential if other countries (far larger than Scotland) also migrate their entire justice systems over to Axon’s platform.

Of course, all this opens up data privacy issues, which is a risk. And the stock is far from cheap nowadays.

Aiming for higher

I wish all my investments had generated Axon-like returns, but the truth is that I’ve bought some duds too.

However, the maths is skewed in my favour because the potential gains from top stocks are theoretically uncapped.

- Axon Enterprise: +1,300% (so far)

- Maximum loss from dud: -100%

Even if I only managed an extra 2% return on the S&P 500 (so, 12%), that’s enough for a £2,352,389 portfolio. In passive income terms, it’s equivalent to £94,095 a year.