Image source: NatWest Group plc

It has been an outstanding year to own shares in high street bank NatWest (LSE: NWG). The share price has surged 65% during the past 12 months. Not only that, it yields 4.9% even after that price increase.

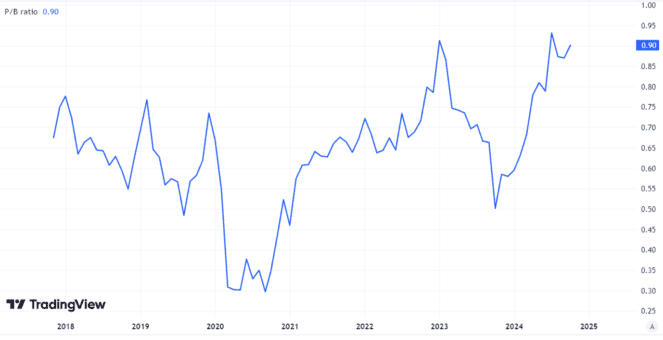

But with a price-to-earnings ratio of 7, the NatWest share price still looks cheap on that measure. As earnings are not always the best way to value bank shares, I also consider price-to-book value when weighing whether to add them to my portfolio.

On that basis too, NatWest shares appear fairly cheap given its strong brands, large customer base and proven profitability. They come in at around 0.9, which is cheaper than the fair value of 1.

Created using TradingView

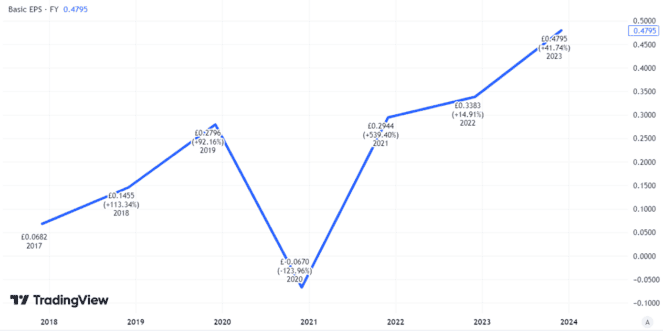

Bank earnings can move around a lot

The challenge with book value or earnings as a valuation metric when assessing bank shares is that both can change, sometimes very quickly.

If the property market suddenly crashes or household income contracts sharply, the number of borrowers that fall behind on their repayments can increase. That can lead to lower earnings or even a move from profit into the red.

Created using TradingView

If property prices fall, a bank’s book value will likely also fall. After all, that value is based on the assets (such as mortgaged buildings) that it carried on its books. So lower property prices can mean a lower book value.

For now, there is no immediate sign that either is about to happen on a large scale. But on a longer-term timeframe, I feel less confident. The economy remains lacklustre, while property prices remain high by long-term historical affordability measures.

Limited supply and strong demand can help support prices, but even when demand outstrips supply, property prices can fall if homeowners struggle to pay for them.

Where things might go from here

That is a risk that weighs on my mind right now when it comes to the share price of British banks, including NatWest. Indeed, it is a key reason that I do not own the share at the moment and have no plans to add it into my portfolio.

The government selling down its stake in the bank (a legacy of a financial crisis era bailout) seems not to have hurt the NatWest share price and from a valuation perspective the bank still looks fairly cheap.

Meanwhile, the longer the business continues to perform well, the more confident I reckon some investors will feel that a hard economic landing is a falling risk. On that basis, I think that even after their recent run, NatWest shares could keep moving up from here.

I would not be surprised to see them at a higher price a year from now, although I do not think the business performance justifies anything like another 65% rise in share price in the coming 12 months.

Despite that optimism though, I will remain on the bench until there is clearer evidence of ongoing strong performance in the global economy and the UK.