Image source: Getty Images

The market did not like a trading update from medical devices manufacturer Smith & Nephew (LSE: SN) released this morning (31 October). As I write on Thursday afternoon, Smith & Nephew shares are down 12% from the closing price yesterday. That makes it the biggest faller of any FTSE 100 share in morning trading.

Does this offer me a possible buying opportunity as a long-term investor?

Disappointing update

In its third-quarter trading update, the company reported 4% growth compared to the same period last year.

That might sound good and certainly not a reason for Smith & Nephew shares to fall. But it disappointed investors.

The company said that, “China was impacted by worse than expected headwinds across our surgical businesses”. It also lowered its full-year underlying revenue growth expectation to around 4.5%, versus 5-6% previously.

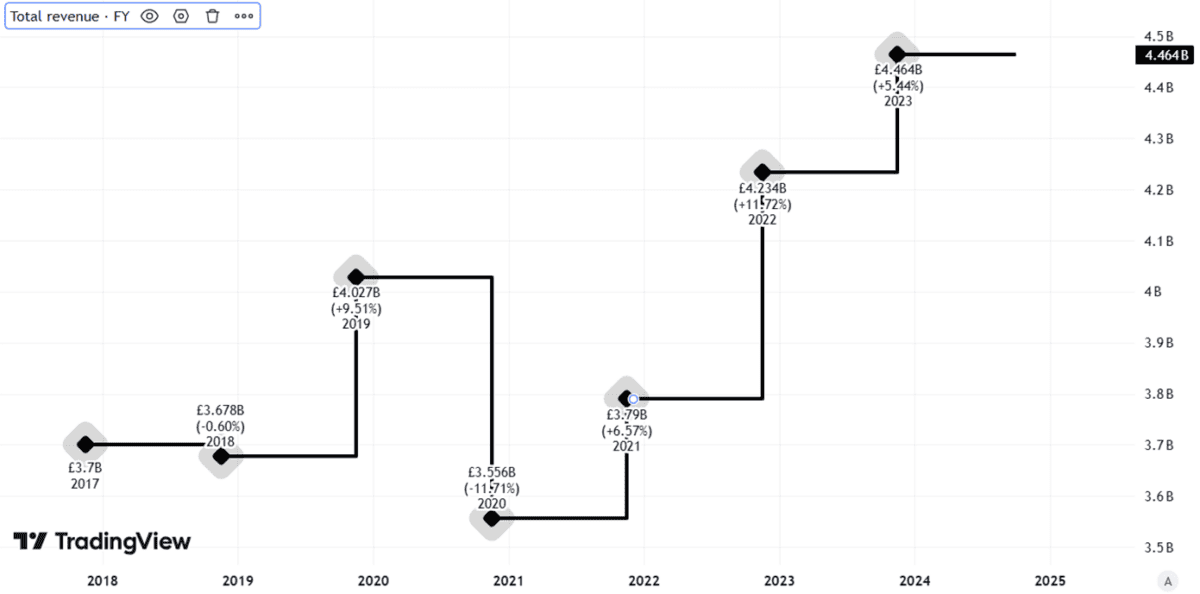

Created using TradingView

Again, that might not sound like a big change.

But bear in mind that we are already over three-quarters of the way through the year, so changing full-year expectations at this point suggests there may be sharply weaker performance still to come in the current quarter.

Will things get better or worse?

I am not persuaded management has really got a handle on how to get the business on track to hit its ambitious growth goals.

In the statement, the company said, “While the revised outlook reflects the headwinds across our surgical businesses in China, we remain convinced that our transformation to a higher growth company… is on the right course“.

In my experience, pinning a sales warning on a single part of the business often foreshadows more widespread challenges. In the quarter, for example, the orthopaedics revenue grew 2.4%. That strikes me as perfectly decent, but it is not the sort of growth I would get excited about if I wanted to invest in a “higher growth company”.

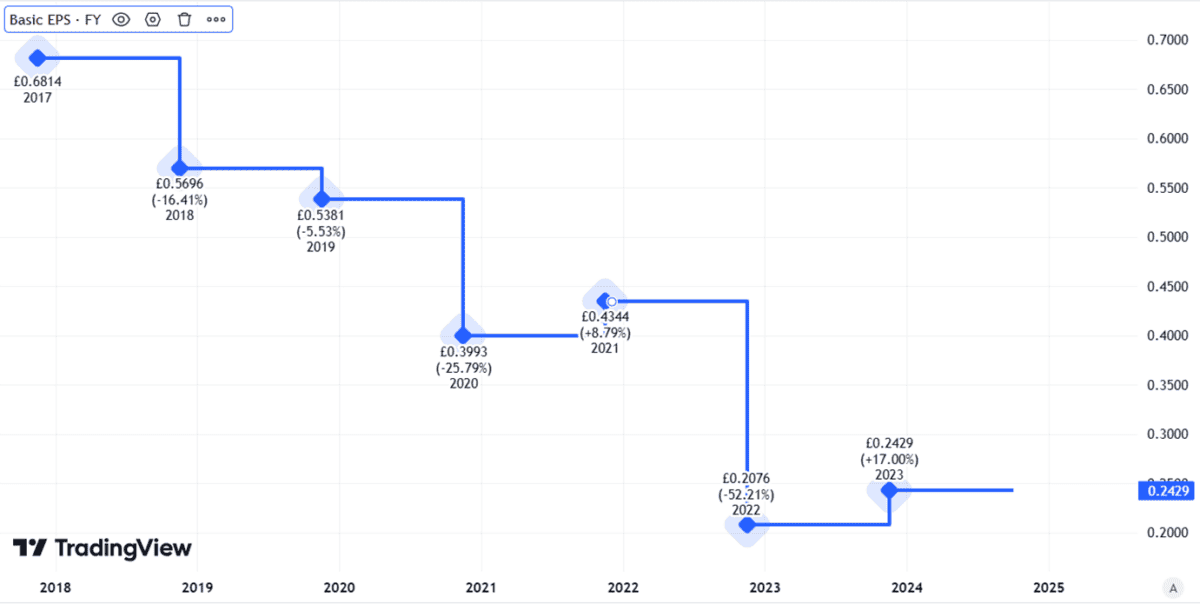

Smith & Nephew’s price-to-earnings ratio of 17 does not seem cheap to me. If the company issues further bad news or underperforms expectations in the fourth quarter or next year, I think it could merit a lower valuation. Earnings per share have declined markedly in recent years.

Created using TradingView

The business does have strengths: a large, resilient target customer market, an established base of buyers, and proprietary technology.

Even just bringing earnings per share back to where they stood a few years ago could help justify a higher price for Smith & Nephew shares.

No rush to buy

But, as the trading statement underlined, there is work to be done.

My concern is that there is more of it to be done that management may currently realise. Having set itself lofty growth goals in recent years, I remain unconvinced as to whether the business can deliver them.

I am thus in no rush to buy the shares and will instead wait to see how the business performs in coming months and beyond.