Image source: Getty Images

Which stocks could be poised to join the FTSE 100 in the New Year? From the FTSE 250 there are several serious contenders, including Alliance Witan, St James’ Place, Polar Capital Technology Trust, and Investec.

These are among the FTSE 250’s largest companies by market capitalisation. However, my top pick to enter the Footsie next year was — until last week — outside this grouping.

With its market cap above £4.5bn, Games Workshop (LSE:GAW) last week catapulted itself higher to become the third-most-valuable stock on the FTSE 250. I’m convinced it’s just a matter of time before it gets listed alongside the FTSE’s big boys.

Market master

This may come as a surprise to some. After all, its products are hardly mainstream.

Games Workshop designs, manufactures, and sells — through its own shops and websites, and third-party retailers — fantasy wargaming systems and their associated miniatures.

It also sells accessories and craft items that bring their products (and their related lore) to life, like paints, glues, brushes, books, dice, and scenery. And it sells them at a huge markup: in the first half of 2024, its core gross margin was a whopping 69.4%.

But why is the company so valuable? One reason is that global interest in tabletop gaming is soaring. The second is that, through its fantasy universes like Warhammer 40,000, Games Workshop is by far the best at what it does, hence those massive margins.

Forecasts beaten

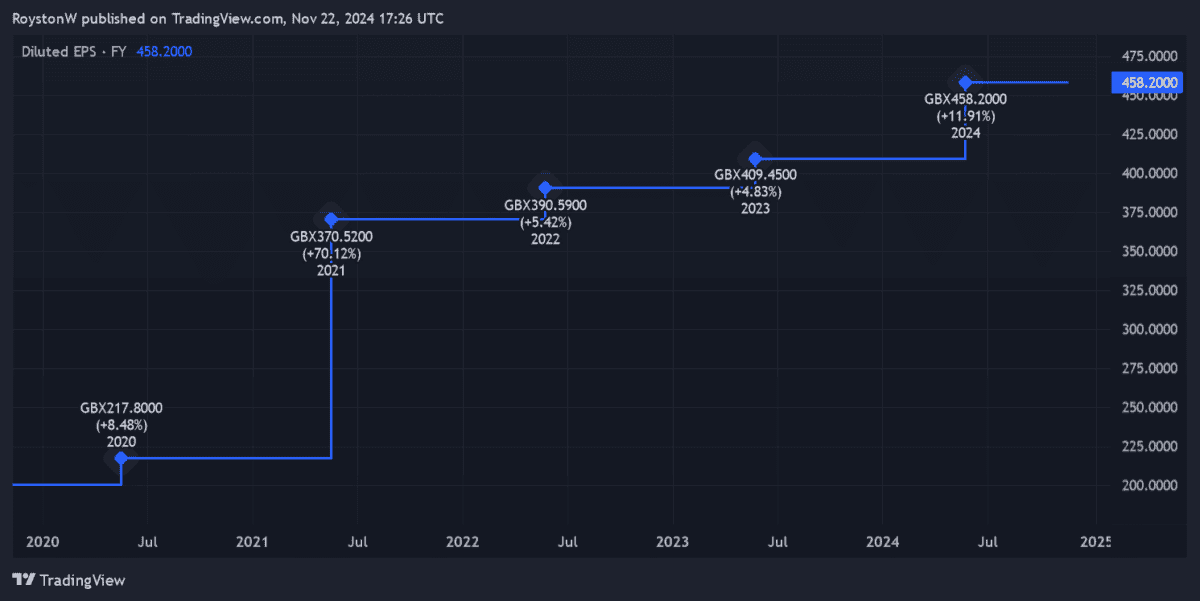

As you can see, Games Workshop’s earnings have risen sharply over the past five years alone. They increased sharply during Covid-19 lockdowns when hobby-related spending exploded. And they’ve kept growing since then.

If latest financials are any guide, earnings growth is heating up again. On Friday (22 November), the firm announced it expected core revenue of revenue of “not less than” £260m in the six months to 1 December.

That’s up from £235.6m a year earlier.

Meanwhile, pre-tax profit was tipped to be at least £120m, up from £96.1m previously.

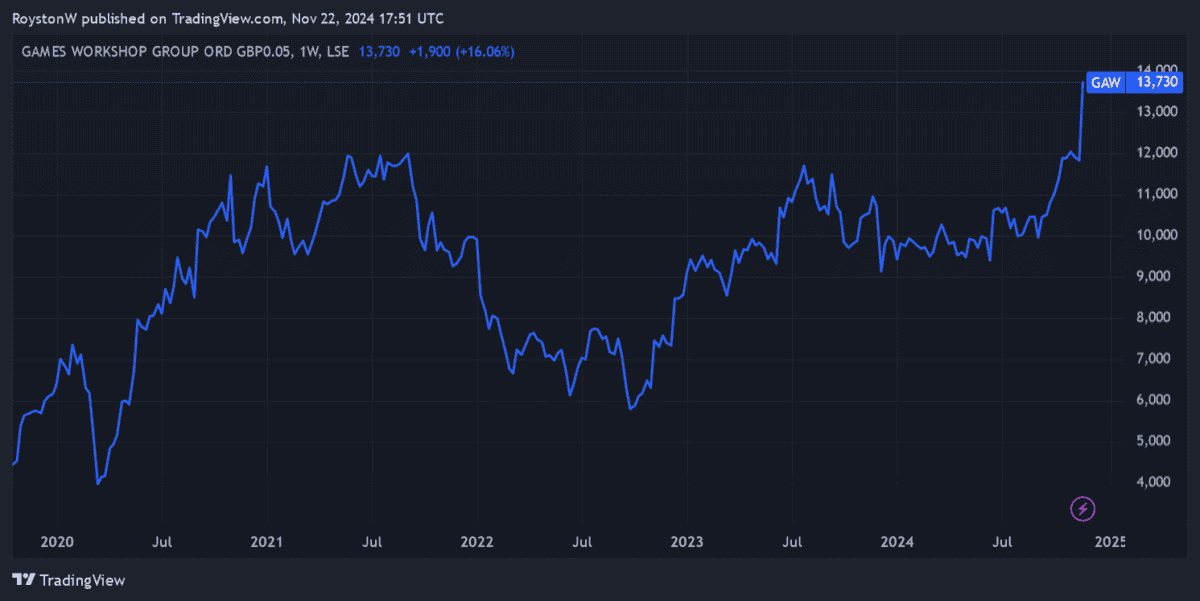

Both sales and earnings for the period beat Games Workshop’s previous forecasts. Its share price jumped 17.3% as a result, to record closing highs of £137.30.

Heading higher

Past performance is not a reliable indicator of the future. But I’m confident that Games Workshop — whose share price is up 141.9% during the past five years — can continue its upwards march.

Global interest in fantasy gaming continues to heat up. And the business is opening new shops, establishing new distribution centres, and boosting production to meet this demand. It now has 548 stores in 23 countries.

It’s also stepping up licencing of its intellectual property to media companies, and is currently talking with Amazon to make Warhammer 40k films and programming. These sorts of deals could bring huge revenues in their own right, not to mention supercharge sales at the company’s core operations.

Games Workshop shares now trade on a forward price-to-earnings (P/E) ratio of 27.7 time. A high reading like this could prompt a share price correction if company-related news flow worsens.

However, I think the company’s worth a premium valuation like this. I already own its shares in my portfolio, and plan to buy more when I next have cash on hand to invest.