Image source: Getty Images

I’m scouring the London stock market for the best dividend stocks and exchange-traded funds (ETFs) to buy today. And I think I’ve found a couple of exceptional candidates for a long-term passive income.

Not only do the following have FTSE 100-beating dividend yields right now. I expect them to provide a large and growing dividend over time.

Here’s why I’d buy them if I had spare £20,000 ready to invest. Based on current dividend yields, they could make me £1,200 in extra income this year alone if I split my investment 50-50.

A cheap ETF

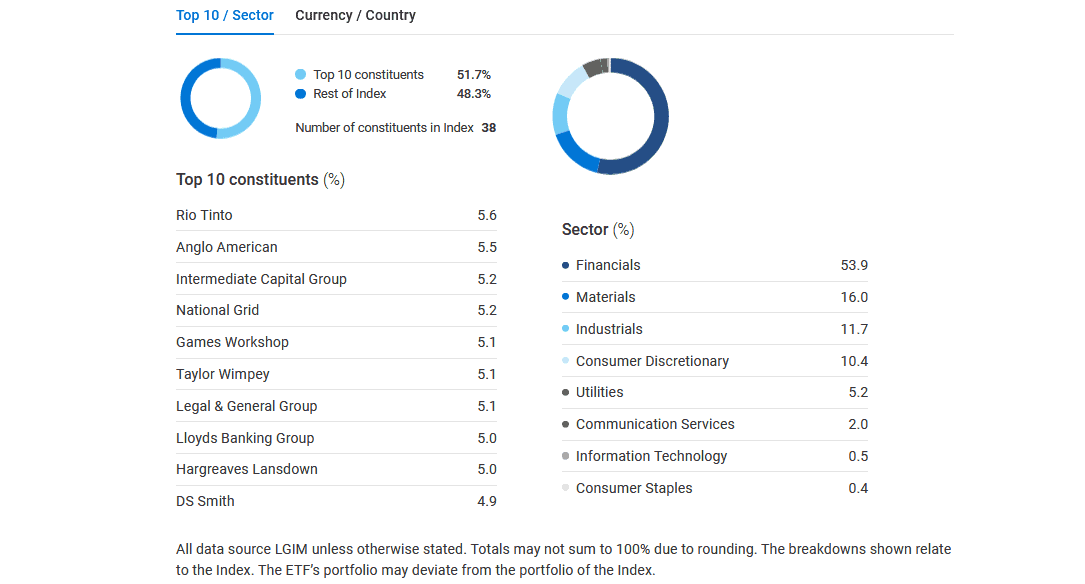

As its name implies, the L&G Quality Equity Dividends ESG Exclusions UK ETF (LSE:LDUK) focuses on British companies with strong records from an environmental, social and governance (ESG) standpoint.

It invests in a basket of stocks — 38 at the last count — excluding those that have “fundamentally poor balance sheet, income statement and/or ESG characteristics“. While dividends are never guaranteed, the first two can make the fund a dependable source of passive income.

Major holdings here include miners Rio Tinto and Anglo American, financial services providers Lloyds and ICG, and utilities business National Grid. This broad diversification can help it to provide a smooth return over time.

One drawback with this fund is its low liquidity compared to other ETFs. This can make it trickier and more costly for investors to enter and exit positions.

That said, I still think it’s worth a close look right now. Its dividend yield’s currently 4.5%, around a percentage point higher than the broader Footsie average.

A FTSE 100 dip buy

Insurance giant Aviva (LSE:AV.) is a FTSE 100 share I already own in my portfolio. I’m considering upping my stake when I next have cash to invest too, owing to its brilliant value.

You see, Aviva’s share price has fallen sharply from above 500p in the past six weeks. I think this represents an attractive dip-buying opportunity.

As the chart below shows, its dividend yield is double the FTSE 100 average of 3.6%. And it rises steadily over the following two years amid City predictions of dividend hikes.

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2024 | 35.43p | 6% | 7.4% |

| 2025 | 38.11p | 8% | 7.9% |

| 2026 | 40.83p | 7% | 8.3% |

On top of this, Aviva shares trade on an undemanding forward price-to-earnings (P/E) ratio of 10.5 times. And its price-to-earnings growth (PEG) multiple sits below the value watermark of 1, at just 0.5.

The financial services firm generates huge amounts of cash, which makes it an attractive target for dividend investors. With a strong Solvency II ratio (205% as of June), it looks in good shape to meet the payout forecasts shown above.

I expect Aviva to deliver a large and growing dividend over time as a growing elderly population drives demand for retirement and protection products. Having said that, intense competition in its markets could impact the firm’s ability to capitalise on this. But I like it all the same.