Image source: Getty Images

Millions of Britons make plans for passive income. Buy-to-let’s undoubtedly popular — in 2023, 4.6m buy-to-let properties were being rented in the UK.

However, it’s not my preferred method of generating extra income. Mine’s investing in stocks and funds, allowing my annual returns to compound until my portfolio reaches a point at which it can generate a significant passive income.

Of course, there’s a caveat here. A varied portfolio doesn’t just mean different stocks, funds, and bonds, in my opinion. For me, a larger portfolios should include various asset classes. This may include a buy-to-let property. Alternative asset classes can include land, cars, and watches.

Let that £99 compound

For those of us new to investing, the way to start is by opening an account with a major brokerage platform like Hargreaves Lansdown, AJ Bell, or Interactive Investor. This allows me to invest my money into companies, funds, and even buy government debt. If I’m investing within a Stocks and Shares ISA, my returns are protected from tax.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

So how does £99 a month compound? Well, to start with I’d need to be making sensible investments that actually perform well. Many novice investors lose money because their investments aren’t built on sound analysis. As such, a sensible place to start could be index-tracking funds.

These are funds that track the performance of major indexes like the FTSE 100 or the S&P 500. Over the last 10 years, the S&P 500 has delivered average annual returns of 12.9%, including dividends, as of August.

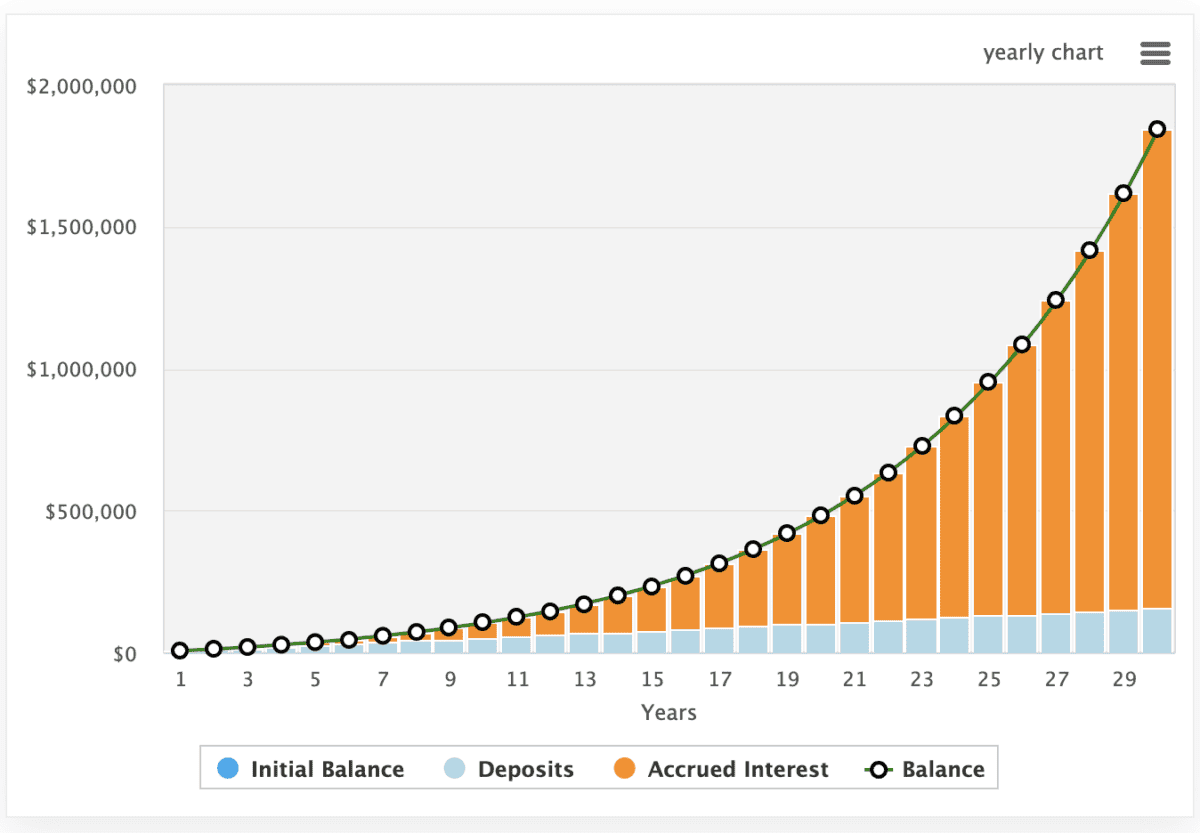

While 12.9% would be a very strong return over the long run, the below chart shows how £99 a week could compound if it did achieve these very strong returns.

After 30 years of investing £99 a week, my portfolio would be worth more than £1.8m, enough to generate at least £90,000 annually in passive income through dividend payments.

Where to put my money?

The Vanguard S&P 500 UCITS ETF GBP (LSE:VUSA) is one of the most popular exchange-traded funds (ETFs) for UK-based investors and is worth considering.

This ETF tracks the performance of the S&P 500 index, which comprises 500 of the largest US companies by market capitalisation.

It employs a passive management approach, aiming to replicate the index by investing in all or substantially all of the stocks that make up the S&P 500, holding each stock in approximately the same proportion as its weighting in the index.

While this is broadly seen a relatively low-risk investment, the S&P 500 fluctuates with the US and global economy. A severe downturn in US economic fortunes would likely result in the value of the investment falling.

However, over the long run, the US economy and US-listed stocks have performed remarkably well. Investors bet against the US at their own peril.