Image source: Getty Images

With a tax-efficient Individual Savings Account (ISA), any of us can significantly enhance our chances of making a big second income in retirement.

Here’s one way a person can try and build a £3,000 passive income with tax-free ISA accounts.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Think carefully

The first thing to say is that there’s no blueprint to investing or saving. We all have different short- and long-term investment goals, as well as varying attitudes to risk and unique sets of financial circumstances.

That said, there are some cast-iron guidelines for investing that some ignore at their peril.

One is that saving predominantly in Cash ISAs is unlikely to make most of us a second income for a comfortable retirement. Put simply, our money may be safe in such an account but the returns one makes are likely to be insufficient, based on most people’s circumstances.

Targeting a £3k monthly income

Let’s say an investor has £514 spare each month. That’s the average amount that Britons currently save or invest, according to financial services provider Shepherd’s Friendly.

If they invested that in a 4%-yielding Cash ISA they would, after 30 years, have £356,741 sitting in their account. Based on a 4% annual drawdown rate, that would give them an income of £14,270, or £1,189 a month.

As mentioned, such income is guaranteed and safe. But even with the State Pension added, this person is unlikely to have the £43,100 that the Pensions and Lifetime Savings Association (PLSA) says that people need to retire comfortably.

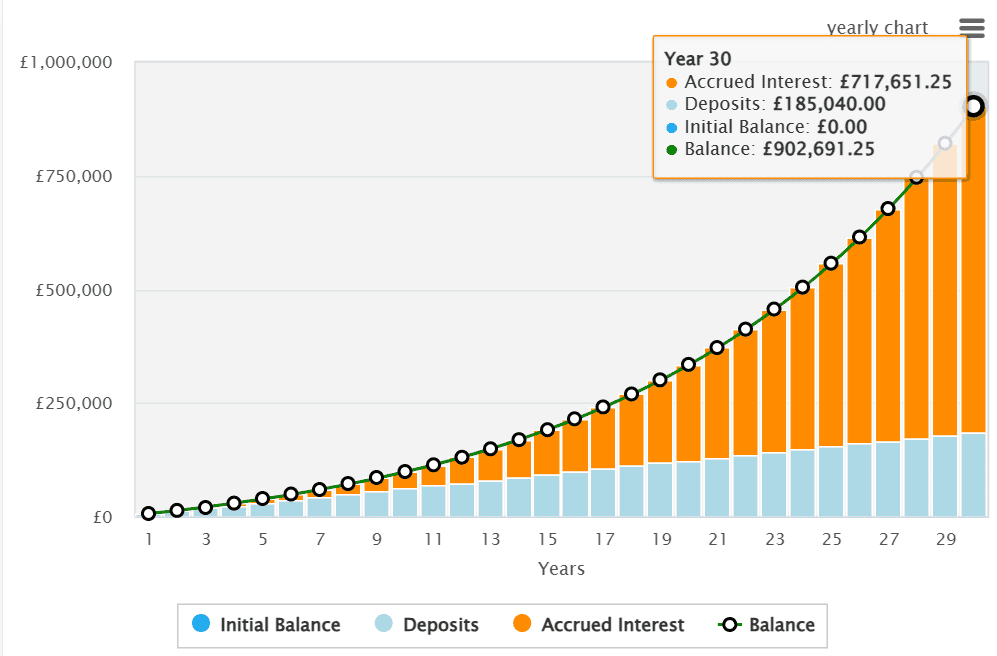

In order to hit this threshold, an ISA investor would need a balance of £900,000 or thereabouts by the time they retire.

Based on that same 4% drawdown rate, this £900k balance would provide an average monthly income of £36,000. With the State Pension added in, that PLSA target of £43,100 could be quite achievable.

This could be achieved by investing in shares that provide an average annual return of 8.8% in a Stocks and Shares ISA.

Investing in funds

That 8.8% return is achievable, in my opinion, based on the proven long-term rates of return of UK and US shares.

The FTSE 100 and S&P 500 have delivered annual average returns of 7% and 11%, respectively. If this continues — which unlike a Cash ISA is not guaranteed — that £514 invested equally across a tracker fund for each index would net an investor that magic £3k monthly second income.

The iShares Core S&P 500 ETF (LSE:CSPX) is one such fund that investors can consider today.

With an ongoing charge of 0.07%, it’s the cheapest S&P-based ETF currently available in the UK. When combined with a Stocks and Shares ISA, it could save investors a huge wad of cash by eliminating unnecessary fees and taxes.

Investing in any fund is riskier than holding cash. However, by investing in 500 different companies, products like this can help investors spread risk effectively while also chasing those superior returns.

In this case, individuals reduce risk with hundreds of different companies spanning many geographies and industries. This doesn’t mean the fund can’t decline during economic downturns. But it can minimise volatility and produce a smooth and solid return over the longer term.

It’s why I hold an S&P 500 fund in my own ISA.