Image source: Getty Images

Defence is a sector I want more exposure to within my Self-Invested Personal Pension (SIPP). With several wars raging and tension between some of the world’s most powerful countries rising, I think allocating some capital to this industry is a smart move.

Now, one way to get exposure to defence is to invest in British firm BAE Systems (LSE: BA.). I’ve taken a different approach however, and bought a defence Exchange Traded Fund (ETF) for more diversified exposure to the theme.

I still like BAE Systems shares

BAE Systems shares do look quite attractive to me. Right now, the company’s revenue and earnings are growing at a pretty healthy rate as countries scramble to protect themselves. Next year, they’re projected to grow 8% and 12% respectively.

Meanwhile, the valuation seems reasonable. With analysts expecting earnings per share (EPS) of 75.9p for 2025, the forward-looking price-to-earnings (P/E) ratio is 16.4 – only a little bit above the market average.

With a single stock however, there’s no guarantee I’ll benefit from the growth of the defence industry. That’s because there’s always a degree of company-specific risk.

In this case, governments could award contracts to other major defence contractors such as Lockheed Martin and L3Harris. Or defence spending could be focused on areas that BAE doesn’t specialise in (eg artificial intelligence (AI)).

So I decided to take a more diversified approach to the defence sector and I bought an ETF for my portfolio. This reduces stock-specific risk considerably.

In 37 years in the intelligence profession, I’ve never seen the world in a more dangerous state.

Sir Richard Moore, MI6 Chief

Broad exposure to the defence industry

The fund I went for was the HANetf Future of Defence ETF (LSE: NATO). This is a relatively new product that was only launched in 2023.

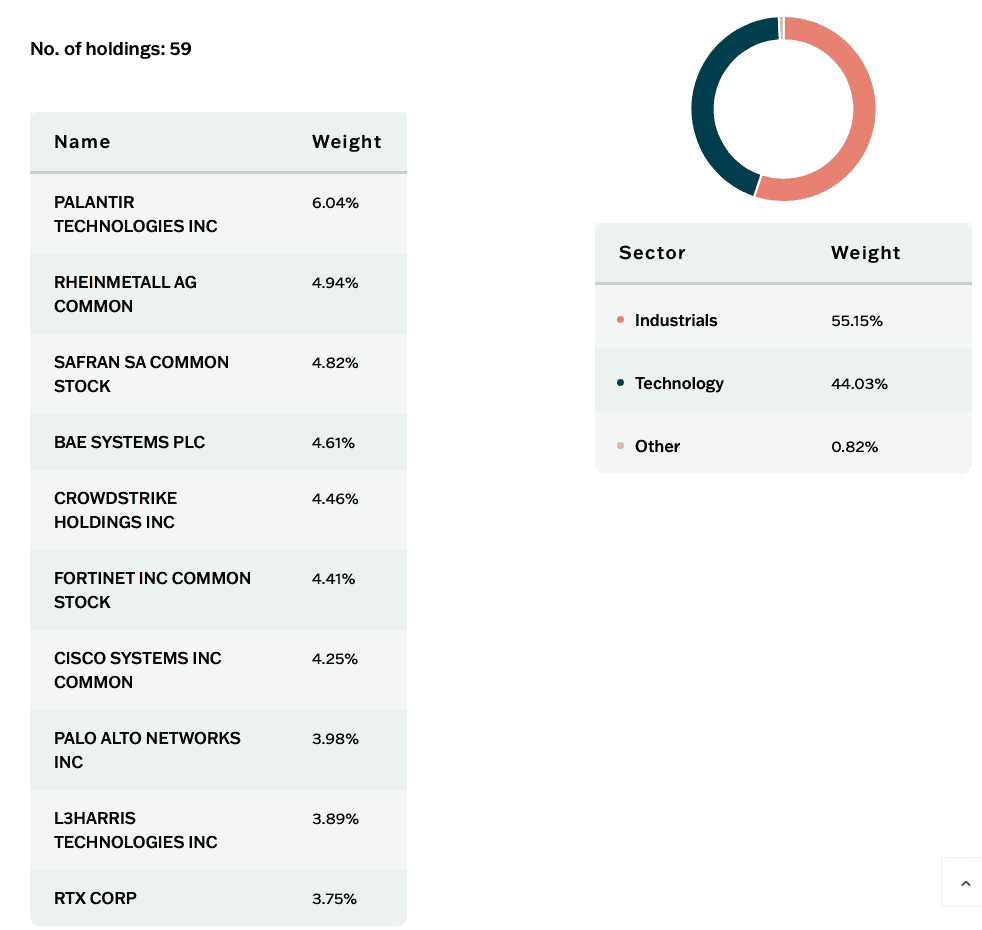

What I like about this ETF is that it gives me exposure to many different defence companies (including BAE Systems). In total, there are nearly 60 stocks in the portfolio (from multiple geographic regions including the US, Europe, and the UK).

I also like the fact that there are companies that are heavily involved in cybersecurity and AI such as Palantir Technologies and CrowdStrike. The nature of defence is rapidly evolving and these kinds of companies give me exposure to cutting-edge technologies that are shaping the future of the industry.

As for fees, they’re pretty reasonable at 0.49% a year. I also need to pay trading commissions to buy and sell however, given that it’s an ETF.

Of course, there are still no guarantees I’ll do well with this investment. If global spending on defence was to drop, the sector, and this ETF, could underperform. Similarly, if cybersecurity stocks were to experience a pullback, the product could struggle.

I’m optimistic it will do well over the long run though. In the years ahead, I expect government spending on defence to remain high.