Image source: Getty Images

Legal & General Group (LSE: LGEN) regularly appears on the list of the most bought shares at the big investment platforms. Not that this ever seems to move the share price, mind. It’s down 10.8% in 2024 and 17% in five years!

So what do these investors (myself included) see in the FTSE 100 stalwart?

Huge passive income potential

The most obvious draw here is the large dividend on offer. Last year, the financial services giant upped its annual payout by 5% to 20.3p per share. The payout for this financial year is expected to total 21.3p.

With the current share price of 224p, this translates into an astonishing 9.5% dividend yield. This means investors scooping up some shares are targeting inflation-busting income.

However, it’s worth keeping an eye on the misfiring share price. If it were to decline 9.5% this year, then that would effectively cancel out the dividend, at least on a total return basis. In other words, the capital loss from the price drop would offset the dividend income.

A fantastic record

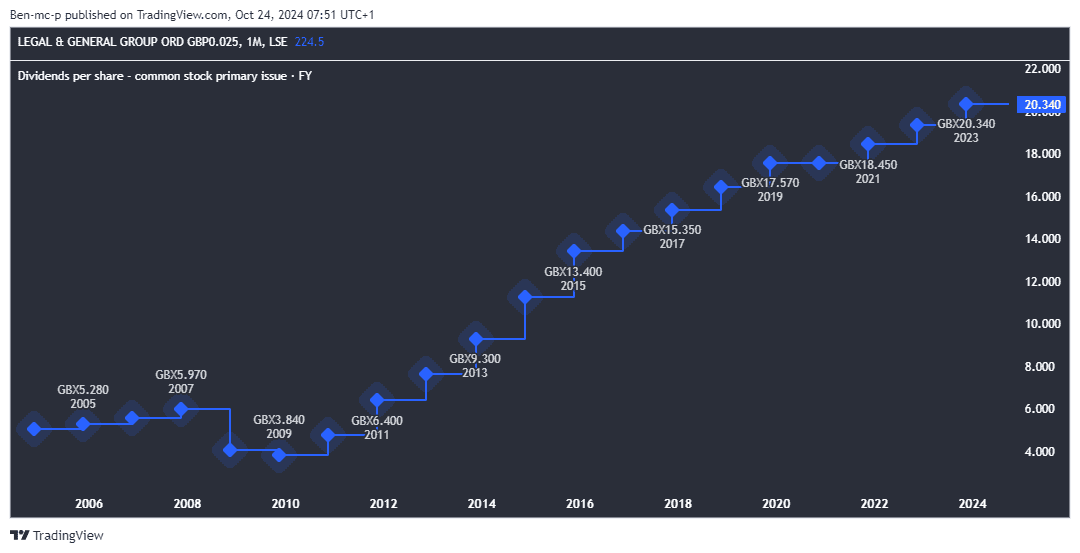

Another likely reason that investors feel confident in the firm is its tremendous track record of dividend growth. Indeed, the payouts have risen like clockwork over many years.

As we can see above, the only blip was during the 2008/09 financial crisis, which is understandable given that the financial services industry was at the epicentre of the chaos. Many firms faced bankruptcy and were bailed out by the government.

This does highlight how dividends aren’t ever guaranteed though, especially when a crisis triggers panic throughout the financial system. These can hit Legal & General’s profits and even lead to a loss.

Financial strength

One outcome of the financial crisis was that it led to stricter regulations and stronger balance sheets across the industry.

Legal & General has consistently maintained a solvency coverage ratio comfortably above regulatory requirements. In the first half of 2024, it was 223%. That’s more than twice the required capital to cover its liabilities, providing a strong buffer and solid base.

Of course, there’s an opportunity cost associated with holding that much capital. Growth hasn’t exactly been exciting at the firm in recent years, and I’d guess that probably explains the disappointing share price performance.

A £100-a-month second income

Looking ahead, both Legal & General and City analysts see the payout increasing by around 2% in 2025 and 2026.

| Year | Dividend per share | Dividend yield |

|---|---|---|

| 2024 | 21.3p | 9.5% |

| 2025 | 21.8p | 9.7% |

| 2026 | 22.3p | 9.9% |

Were next year’s dividend of 21.8p to be met, we’d be looking at a jumbo 9.7% yield. In practice, this means I’d need 5,505 shares to target £1,200 a year in passive income — the equivalent of £100 a month.

Those shares would cost around £12,337. If I couldn’t afford that sum upfront, I could invest £343 a month to build up that position over three years.

Of course, this is just an illustration. In reality, the share price will move up and down. When it falls, I’d get more shares and a higher yield, and vice versa. I also wouldn’t ever rely on a single stock for dividends.

Legal & General remains a stalwart in my own passive income portfolio. I plan to buy more shares before Christmas to lock in that 9%+ dividend yield.