Image source: Getty Images

Stock market investors have been treated to a white-knuckle ride in April. It’s been a month characterised by moments of fear, euphoria, wild volatility, and enormous share price swings thanks to Trump’s tariffs roller coaster. Consequently, both the FTSE 100 and S&P 500 are in the red for 2025 thus far.

But one ‘safe haven’ asset is proving its mettle amid massive stock market turbulence. The gold price recently reached a new record high above $3,200 per ounce. Many analysts believe bullion could continue to rise in the months and years ahead.

VanEck Junior Gold Miners UCITS ETF (LSE:GDXJ) is an exchange-traded fund (ETF) that offers exposure to the gold mining sector. Here’s why it’s worth considering in today’s challenging investing environment.

A unique form of gold exposure

Investing in gold mining stocks presents different opportunities and risks than buying the pure commodity itself. Naturally, there’s a strong correlation between the price of gold and the share prices of companies that mine the precious metal.

But gold miners can sometimes outperform or underperform price movements in physical gold. Due to operational performance, production costs, and leveraged gold exposure, mining firms have distinct dynamics for investors to bear in mind.

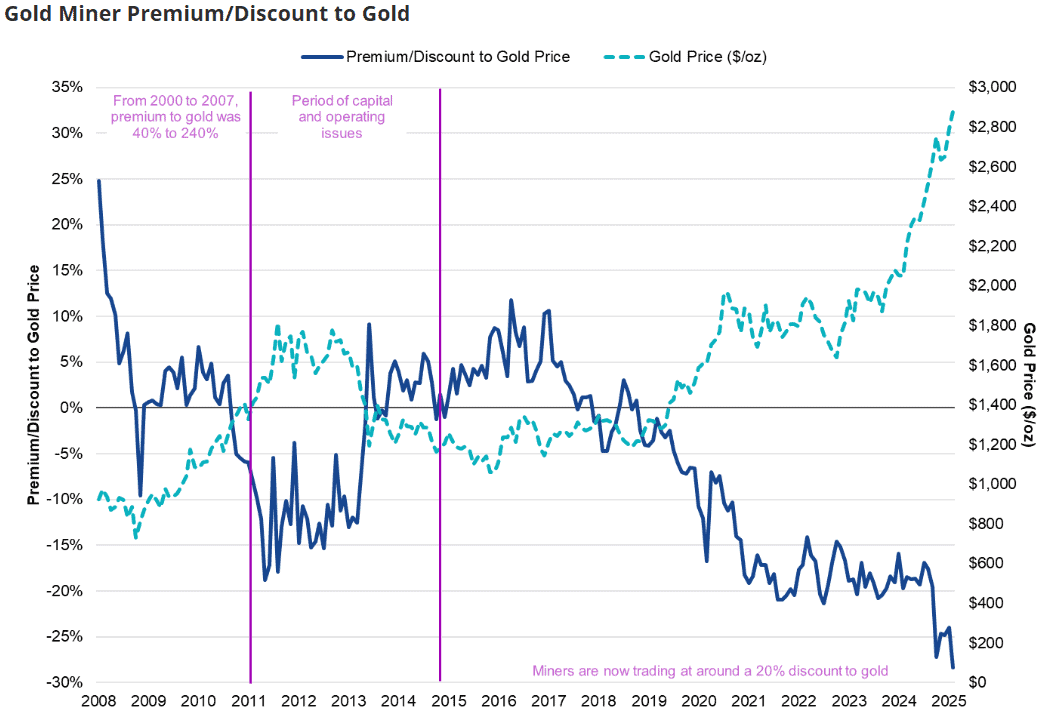

In recent years, a significant discount has emerged between gold miners and the yellow metal. This suggests there could be a potential value investment opportunity in gold mining shares today. The gulf may start to narrow.

Investing in early-stage miners

The VanEck Junior Gold Miners UCITS ETF is the only fund of its kind available in Europe. It offers exposure to smaller mining stocks, “some of which are in the early stages of exploration“.

Just under 59% of the 84 companies in the ETF’s stock market portfolio are defined as mid-cap stocks, valued between $3bn and $20bn. Some familiar examples from the FTSE 100 index include Endeavour Mining and Fresnillo. The remaining share holdings have market caps below $3bn.

Investing in companies in the early stages of their growth cycles can be attractive since there’s potential for takeovers by larger producers. Often, shareholders stand to benefit from such moves. Acquisition targets can experience share price spikes during negotiations, although this isn’t always the case.

However, such firms also have higher share price volatility than more mature miners. They also carry greater risks of default and can be less competitive.

Shelter from the stock market storm?

Gold mining stocks often experience price fluctuations that are independent of broad market cycles. In times of uncertainty, these firms can benefit from investor anxiety. As we’ve seen this year, capital can rapidly flow from other areas of the market into safe haven assets.

That said, VanEck’s ETF isn’t immune to current difficulties. Nearly 48% of the portfolio is concentrated in Canadian gold mining companies. These businesses rely on the US as a major export destination.

Trump’s decision to impose 25% tariffs on Canadian imports could make gold from the country inordinately expensive for American refiners and jewellers.

Nonetheless, I think this ETF could be a handy portfolio addition to consider. I wouldn’t want to be overly exposed to gold miners, but they can offer useful diversification for investors concerned about wealth preservation in today’s choppy stock market.