Image source: Getty Images

The market’s been punishing any growth stock that fails to live up to high expectations. One new stock in my portfolio — Duolingo (NASDAQ: DUOL) — fell victim to this, slumping 33% since mid-February.

Here’s why I’ve used this dip to buy more shares.

Market leader

Duolingo ended 2024 with 116m monthly active users, making it the world’s leading language learning app. It offers courses in more than 40 languages, ranging from English and Spanish to fictional ones like High Valyrian from Game of Thrones.

On St David’s Day (1 March), Prince William delivered his first full message in Welsh. Turns out even the Prince of Wales has been using Duolingo to improve his language skills!

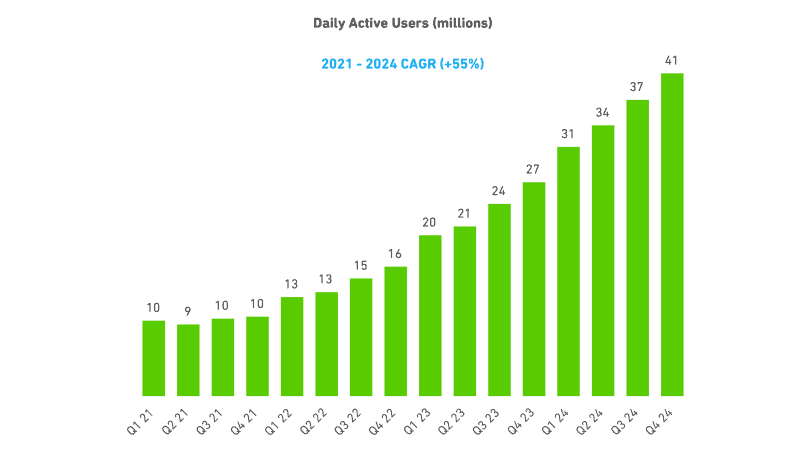

Last year, the firm’s revenue surged 41% to $748m, with the adjusted EBITDA margin reaching a record 25.7% ($192m). In Q4, daily active users rocketed 51% to 40.5m, while paid subscribers jumped 43% to 9.5m.

Prioritising AI over profitability

These are healthy numbers. So why has the stock bombed? Well, the company beat Wall Street’s estimates for revenue, but Q4 earnings per share (EPS) came up short ($0.28 rather than $0.50).

Another issue can be found in the quote below:

While we expect to continue growing margins this year, we will do so at a more measured pace due to the investments we are making into AI and the variable costs associated with Video Call. We see a tremendous growth opportunity ahead.

CEO Luis von Ahn

Basically, management’s warning that strategic investments in artificial intelligence (AI) will weigh on profitability in 2025. The video call feature enables users to have real-time, AI-powered conversations in their chosen language with Lily, one of the app’s characters. This interactive tool is exclusive to Duolingo Max, the premium subscription tier.

My view

To be frank, I don’t really care about profit optimisation this year. As a shareholder, I want management to invest in cutting-edge AI features that boost user acquisition, engagement and improve subscriber conversion. This should ultimately strengthen the platform’s competitive positioning and long-term monetisation potential.

AI and automation tools have driven at least a tenfold increase in the company’s content generation capacity over the past two years. Once courses are developed, adding new users incurs minimal additional costs. In other words, Duolingo’s platform is highly scalable, with real cash machine potential.

I recently upgraded to Duolingo Max. The video call feature preserves context from prior conversations in Spanish. If I mention a hobby, say, Lily may bring it up later, making interactions more personalised and engaging.

It’s one of the most powerful consumer applications of generative AI I’ve experienced. Yet just 5% of Duolingo’s learners use it so far.

$1bn in bookings

Now, this investment isn’t without risk. A spike in inflation could cause consumers to downgrade their paid subscriptions to Duolingo’s free offering. And inflation might negatively impact international travel, and therefore the motivation to learn a new language.

Also, based on 2025 forecasts, the stock’s trading at an enterprise value-to-sales multiple of 12.7. That’s not cheap.

However, Duolingo’s on track to surpass $1bn in bookings this year. Revenue is projected to hit $1.8bn in 2028 — roughly 140% higher than last year. I think the stock’s worth considering.