Image source: Getty Images

The potential gain from owning shares in Lloyds (LSE: LLOY) over the past year has been considerable. During the past 12 months, the Lloyds share price has moved up 36%.

On top of that, there is a dividend yield of 4.5%. Someone who bought the shares a year ago at the lower price however, would now be earning a yield of around 6%.

Still, with the Lloyds share price still in pennies, might there be further room for increase – and should I invest?

The price could rise again

To answer the first of those two questions, I do think the share could move even higher from here. The price-to-earnings ratio of 11 strikes me as reasonable, rather than overly expensive.

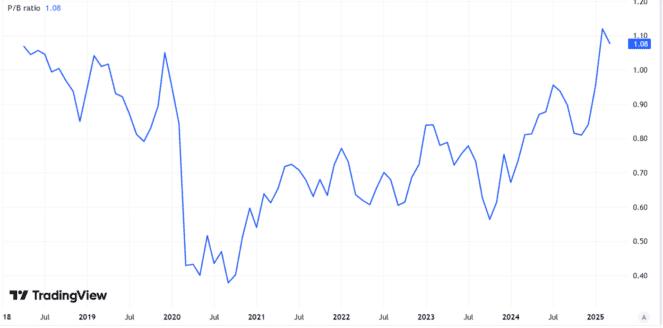

When it comes to valuing banks however, many investors prefer to use a price-to-book value ratio. Here, the picture is less attractive. Not only has the share become more expensive lately using this ratio, it now also looks potentially overvalued, as a ratio above 1 indicates that the share price is higher than the underlying book value.

Created using TradingView

So why do I think the Lloyds share price could still move higher from here? As the past year’s rally shows, many investors have continued to buy into the bank. With a proven business model, strong brands and large customer base in a market with high barriers to entry, I see a lot to like about Lloyds.

If it can maintain or improve its business performance, that could help justify a higher share price.

An ongoing share buyback programme should also push up both the earnings and book value per share, potentially justifying a higher share price for Lloyds.

Here’s why I’m not buying

Despite that however, I continue to avoid the share and have no plans to add Lloyds to my ISA or SIPP at the present time.

I recognise the bank’s strengths but see challenges from an uncertain economic outlook. Given Lloyds’ role as the country’s leading mortgage provider, that could eat into profits if loan defaults rise. There are also other risks, such as ongoing costs from a car financing mis-selling scandal.

Last year saw the bank’s post-tax profit fall by nearly a fifth. Yes, it was still a mammoth £4.5bn. But a fall on that scale does not fill me with confidence about the outlook for the business.

Despite share buybacks, the Black Horse Bank’s basic earnings per share have moved around in different directions over the past several years.

Created using TradingView

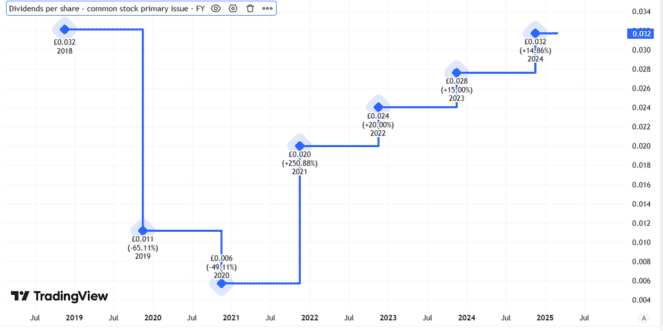

Those buybacks actually put me off investing, as I think the board would have done better to use spare cash to restore the dividend per share to its pre-pandemic level.

Instead, it has dragged its feet for years on this, making me think it does not fully appreciate the importance of the dividend to many investors.

Created using TradingView

So although I reckon the Lloyds share price may move higher still, I also have concerns about the risks of investing at the current level and have no plans to do so.