Image source: Getty Images

Although I have less than 10% of my portfolio in Barclays (LSE: BARC), it’s responsible for about a third of my second income earnings this year. That’s partly because I’ve held it for longer than other stocks — but it also pays a reliable dividend and has had a spectacular year.

After trudging through 2022 and 2023, it finally found its feet this year and took off running. The promise of falling interest rates on the back of an improving economy lit a fire under bank stocks.

Lloyds and HSBC also enjoyed decent gains but neither have done quite as well as Barclays.

But with the stock soaring 56% this year alone, I’m wondering how long the party can go on.

The issue of interest rates

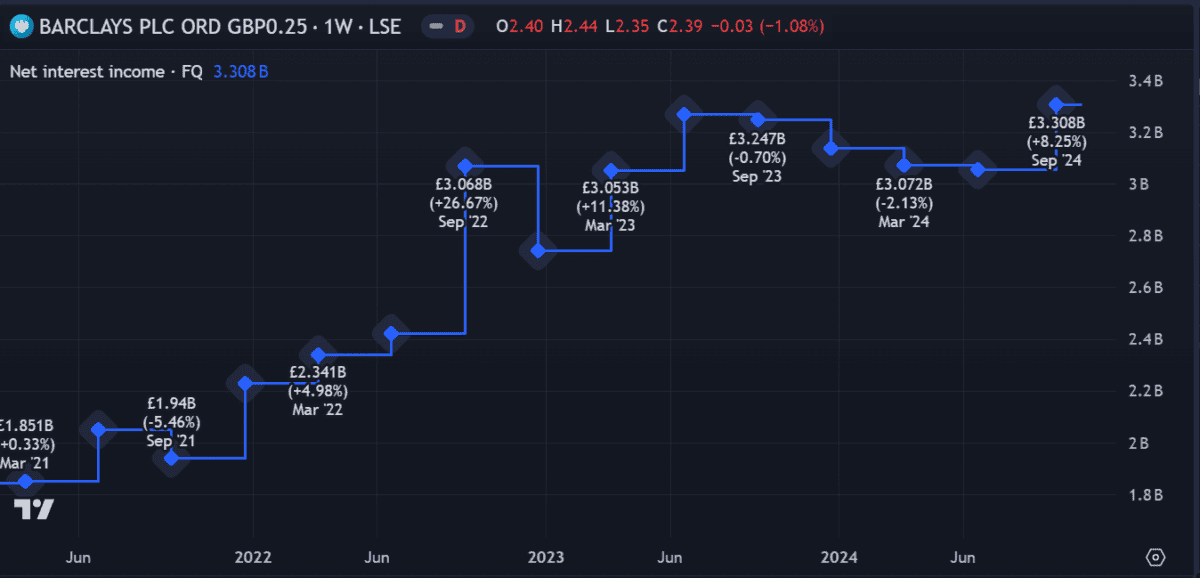

As one of the UK’s major banks, Barclays has been riding the high-rate wave, accumulating record revenues from increased loan interest. With annual profits reaching £7bn in 2023, it demonstrated its ability to adapt to a higher-rate environment effectively.

By capitalising on the widening gap between what it charges borrowers and pays depositors, the bank has bolstered its net interest margin (NIM) — a key indicator of profitability.

But with the Bank of England on the cusp of another potential rate cut, the era of easy money might be nearing an end. This looming shift has critical implications for future profits, with reduced rates threatening to cut into revenue from loans.

How rate cuts could hurt the bank

With customers refinancing and securing new loans at lower rates, I’m wondering how much longer Barclays will remain my top earner. Here are a few ratios that could be affected by rate cuts.

- Return on equity (ROE) could fall if NIM is compressed, as profitability declines relative to shareholder equity.

- Earnings Per Share (EPS) are likely to take a hit if revenue falls, making the bank less attractive to potential investors.

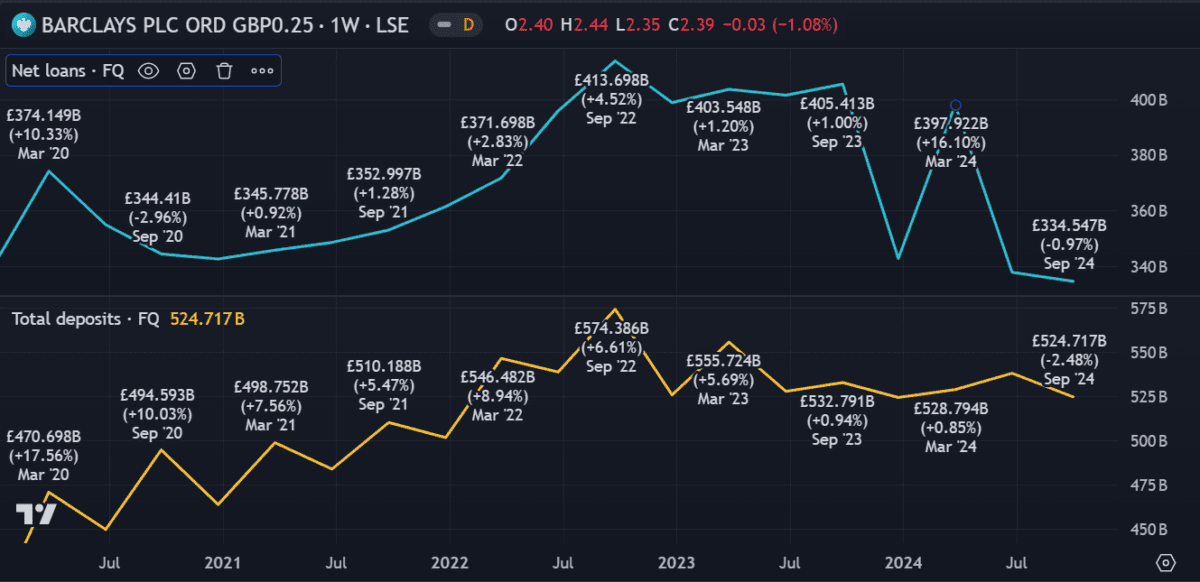

- If Barclays seeks higher-yielding assets to replace lost loan income, its loan-to-deposit ratio could increase. This is a key indicator of the bank’s liquidity. With £334bn in loans and £524bn in deposits, it currently sits around 63.7%.

How rate cuts could help the bank

On the flip side, a rate cut could encourage a surge in borrowing, which might help to counterbalance falling NIM. Lower interest rates can stimulate borrowing across sectors, especially in real estate, small business, and personal finance.

For banks, this means a possible influx of new loans, even if at lower yields, keeping balance sheets active and potentially introducing a broader client base to the bank’s financial ecosystem.

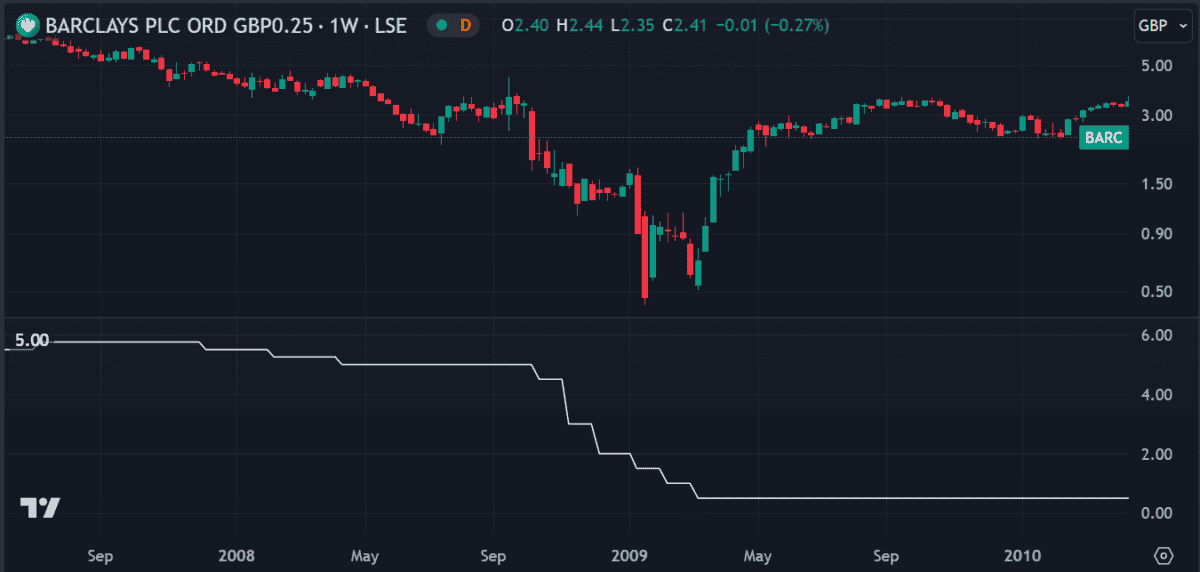

The below graph shows how falling prices during the 2008 financial crisis prompted rate cuts, which spurred a mild recovery before further losses. Back then, it took several months for Barclays’ shares to fully recover, while interest rates remained low.

In today’s vastly different economic climate, I don’t expect similar losses.

There’s no guarantee this year’s impressive growth will continue, but I don’t see anything to indicate an immediate threat to price performance.

Even if growth tapers off, I’m happy to hold my shares as the 3.4% yield keeps the investment profitable.